Why am I concerned with cost budgeting?

|

Cost budgeting or setting the cost baseline for a project is very important since it forms the foundation for the measurement of performance in the project. Ultimately our performance measurement system is going to measure the actual costs of the project in terms of time and quantity and compare that to the planned expenditures in terms of time and quantity. Any error we have in the amount of budget set aside for a particular activity in our project or the timing of that expenditure will result in overor understating the performance of that part of the project team. If one of the tasks in the project is budgeted for $2,000 when it should have been budgeted for $1,500, the performance on this overbudgeted task will be unjustifiably high. Worse, the actual cost of the task could actually be $2,000 because work tends to fill the time allowed and spend the amount for which it was budgeted. Most managers will not take corrective action when tasks are being done within their predicted budget.

Setting of budgets also has an effect on the business itself. All companies have financial managers who must concern themselves with the timing of the expenditures of the company and making sure that there are funds available to pay the bills. Budgeting too much for a project means that excessive funds that are not required will be on hand. Not budgeting enough for the project means that funds will have to be found for the project on short notice.

Tell me more …

Placement of the budget in terms of the amount of money that will be spent on the individual tasks of the project as well as the timing of those expenditures is necessary for any performance measurement system to work. It is also important in helping the company manage its cash reserves so that enough, but not too much, money is available when it is required to pay bills that become due.

Any performance measurement system will be a measure of the comparison of the expected result to the actual result. In the case of projects, we are usually interested in the measurement of performance in terms of the amount of money that is being spent and the time in which it is spent. The earned value reporting system is excellent for measuring project performance but requires careful placement of the project plan in terms of quantity and timing of the planned expenditures. If the planned expenditures are not in close synchronization with the actual expenditures in terms of quantity and timing, the project will indicate a level of performance that is higher or lower than is actually the case. Suppose we have a project with a sizable amount of internal labor being used to complete many of the project tasks. We plan the expenditures for this work according to the project schedule. The project schedule shows when the work is taking place. Each person working on project tasks reports the work by task worked on and by the number of hours spent on each task. We will assume that we are doing this on a weekly basis. So, for example, Saralee works on four different tasks during the week. She works twenty hours on task one; ten hours on task two; four hours on task three, and six hours on task four. The time card she reports this on is sent into the payroll system in the accounting department and processed through the computer system. Corrections are made in the payroll system, and a report comes to the project manager one week later. At that point the time is shown as actual cost, but it is a week later than the time when the work was actually done. In addition, if the project manager finds a mistake on the report, it will take another week for the report to be corrected.

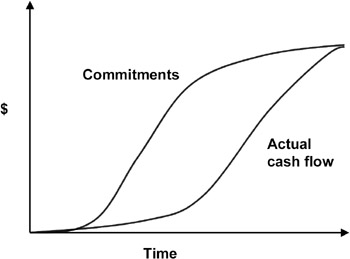

Figure 4-1 shows the overall effect of timing on cash flows. The timing of planned and actual cash flows must be the same or project status and performance reports can be misleading.

Figure 4-1: COMMITMENTS AND ACTUAL CASH FLOW

This problem can become worse if there have been errors in reporting from other projects or functional areas. What we mean by this is that one department or project team accidentally charges time to one of your project tasks. If you catch it at all, it is in a report that you see one week later. If you find the error and make the correction, it will be another week before the report shows it correctly. If the change requires approval of the person who made the mistake in the first place, it may take another week for the change to be made. All this makes the timing late for the actual cost to be recognized. Meanwhile the work has been done, and the completed work has been credited to the project, but the actual cost is less than it should be, and the performance is unjustifiably high for that task.

Material cost is a problem as well. Frequently the task of ordering material for a project is considered complete when the project team has finished the work.

Figure 4-2 shows that there is quite a lot of time involved between the time when the project team finishes the work of writing the requisition for materials for the project and the time when the actual cost of the expenditure is recognized. It is most convenient for the project team to recognize the completion of the work when the work of the project team is complete, but it is more accurate if the cost is recognized at the time the invoice is paid. In terms of the timing of the completion of the task, it is better to show the task as being completed when the person doing the work has completed the work.

Figure 4-2: TIMING THE BUDGET

As far as the quantity of money spent on the material is concerned, it may be better to show the expenditure when the actual invoice is paid. Final payment for items purchased usually includes the cost of inbound shipping and any other price adjustments. The shipping cost is usually not included in the original requisition but is included in the final cost of the purchase.

It is extremely important that the timing and quantity of the planned expenditures and the timing and quantity of the actual expenditures be synchronized. It is less important that they be recognized at the precise time they occur than it is that planned and actual costs be recognized at the same time. It does not matter very much if the planned and actual expenditure on any material is shown early in the project or late in the project. It does matter that the planned and actual costs be shown at the same time. If actual costs are shown later than they were planned, the project will be shown as healthy when it could be in trouble. If actual costs are shown before the planned costs, the project will appear to be in trouble when it is not.

Suppose we have a project that requires the purchase of a piece of equipment to be used exclusively for this project. This equipment has an estimated cost of $50,000. The completion of the equipment investigation and the issue of the requisition are scheduled for April 1. It takes the vendor two months to deliver the equipment. The payment for the equipment is made one month after delivery. Suppose our earned value reporting system recognizes the equipment in the plan when the project team generates the purchase requisition, but the actual cost is not recognized until the invoice is paid. Table 4-1 is an excerpt from the project's earned value reporting system.

| Date (Week ending) | Planned value (PV) | Actual cost (AC) | Earned value (EV) | Cost performance index (CPI) |

|---|---|---|---|---|

| April 1 | 300,000 | 250,000 | 300,000 | 1.20 |

| April 8 | 400,000 | 350,000 | 400,000 | 1.14 |

| April 15 | 500,000 | 450,000 | 500,000 | 1.11 |

| April 22 | 600,000 | 550,000 | 600,000 | 1.09 |

| April 29 | 700,000 | 650,000 | 700,000 | 1.08 |

| May 5 | 800,000 | 750,000 | 800,000 | 1.06 |

| May 12 | 900,000 | 850,000 | 900,000 | 1.06 |

| May 19 | 1,000,000 | 950,000 | 1,000,000 | 1.05 |

| May 26 | 1,100,000 | 1,050,000 | 1,100,000 | 1.05 |

| June 2 | 1,200,000 | 1,150,000 | 1,200,000 | 1.04 |

| June 9 | 1,300,000 | 1,250,000 | 1,300,000 | 1.04 |

| June 16 | 1,400,000 | 1,350,000 | 1,400,000 | 1.04 |

| June 23 | 1,500,000 | 1,450,000 | 1,500,000 | 1.03 |

| June 30 | 1,600,000 | 1,600,000 | 1,600,000 | 1.00 |

| July 7 | 1,700,000 | 1,700,000 | 1,700,000 | 1.00 |

| July 14 | 1,800,000 | 1,800,000 | 1,800,000 | 1.00 |

| July 21 | 1,900,000 | 1,900,000 | 1,900,000 | 1.00 |

In this example, because of the error in timing for reporting the $50,000 expenditure, all of the cost performance index (CPI) calculations during the month of April, May, and June (through June 23) show the project having a CPI greater than 1.00. This indicates that the earned value (EV) of the total project is greater than the actual cost (AC) for the project. In reality the project's CPI should be 1.00 for the entire time.

![]()

Financial managers for our company also depend on the accuracy of our estimates and the timing of our budgets. Money costs money whether we borrow it or get it from our investors. The cost of money is generally expressed in terms of the interest rate, which is just a way of stating the amount of money it costs to use money. When we use someone else's money, we have to pay them for the use of it.

The challenge to the financial manager is to have enough money on hand to pay all the bills as they come due but not have a surplus of funds that the company is paying to have on hand but does not need. In the example above, if the project plan called for the acquisition of the $50,000 piece of equipment on April 1 and the invoice was not paid until July 1, we were holding the money unnecessarily for three months. The cost to hold the money is approximately $1,250, assuming a 10 percent annual interest rate.

![]()

While $1,250 might not seem like a lot of money in a single purchase on a single project, if these types of errors are occurring on many projects, the cost of holding surplus funds unnecessarily adds significantly to the cost of the projects. I would not like to pay this money out of my salary. Of course the problems associated with not having enough funds to pay the bills when they become due is worse. On-time payment discounts can be lost, and interest rates to obtain money on the short term are higher.

Financial managers often learn not to trust project estimates and schedules if the project managers have a history of not making their expenditures happen when they plan them. An untrusting financial manager may anticipate budget overruns by having too much cash on hand. This raises the cost of the money needed for the project if the project follows its plan.

The lesson then is that we must have accurate predictions of when these expenditures will be made so that our financial planners can be sure to have the money on hand when the bills are due. To do this we must carefully budget our projects in terms of the amount of money and the date when it will be spent.

|

EAN: 2147483647

Pages: 126