Comparative Assessment of Profiled Applications

|

Comparing the "service profiles" of Figure 3 can be like comparing apples and oranges. Many such services exist in various rudimentary or specialized forms today but will obviously evolve over time. The initial phase of business-oriented wireless services can be characterized as the early attempts of an industry to address business needs. Hence, the focus is on existing niche needs, like e-mail, information downloads, or generic business user needs, like flight schedules, weather, stock market updates, or communications with the home office. The step from these rudimentary applications to the next generation of streamlined business-and user-specific applications will be slow at first but would accelerate as business users realize the operational and competitive advantages of such services. Service suppliers (wireless operators) would also begin to see the opportunities associated with addressing their business customers' needs by providing a "business solution" focus, eventually targeting corporate and individual business functions. As the new services evolve, the full range of market-seeking supply-demand variables would come into play. The result would be a mix of services, marketing approaches, and price-performance points. Some services will be priced low and others high, depending on the specific market characteristics, competitive situation, and specific customer segment variables. A "service value" framework is critical in assessing how individual services are positioned and targeted (and how the service mixes and how implementations change over time).

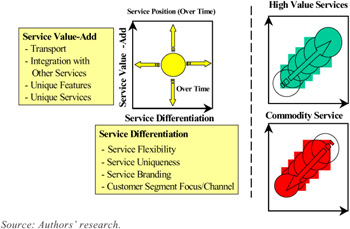

Such a framework is described in Figure 4, focusing on the core dimensions of "service value-add" and "service differentiation." The service value-add is comparable to the "network value-add" described while profiling the various services in the previous section. Service differentiation introduces a new and fundamental marketing aspect to the assessment. The opportunities presented by the network-aided "mobility" aspect, described in the preceding section, create new ways for differentiating service offerings over time. This variable is critical for the m-business services marketplace; it is what makes the m-business offerings unique. For example, a simple m-Yellow-Pages service may be implemented and priced in a totally different way for a year-round delivery through a business terminal than for a onetime delivery through a disposable consumer terminal. The service may be limited in both implementations: the first focusing on B2B Yellow Pages and the second on information from, for instance, a specific retail chain that gives away the disposable terminals to be used by their customers while visiting the store.

Figure 4: Core Dimensions for Comparing Network-Enabled M-Services

At the same time, real service value-add often tends to be reflected in whether a service becomes a commodity service or a fully differentiated service over time. Existing mobile services tend to be a poor guide in this evaluation. They represent the results of addressing yesterday's opportunities instead of tomorrow's opportunities. The values are therefore skewed, overemphasizing existing business models instead of evolving business models. Consider, for example, the ability to imagine Web-based document distribution in the year 1990. No one today would print and distribute binders of documentation instead of just providing them online, but in 1990, this "business model" would have made little sense. In the evolving m-business models, information and effectiveness/efficiency improvements would be critical in deciding (high) value, while more mundane information distribution services will become "commodities." If implemented along these lines, high-value services have the opportunity to become high-profit services, while broadly defined commodity services would tend to be under constant price pressure over time. This is where service differentiation and value-add both come in. In order to continue to position the service in the upper right-hand corner of Figure 4, the service provider must be able to continuously add new service value-adds and provide differentiation. Unless supported by a strong external differentiator or truly unique value-adds, services tend to drift toward the lower-left corner over time.

|

EAN: 2147483647

Pages: 139