Equivalence of Response

|

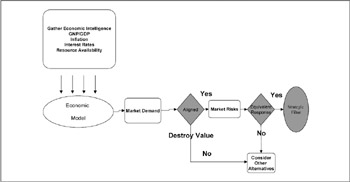

Balancing long- and short-term feedback is the key to success. Delivering immediate financial results must not come at the expense of the future viability of the business. This means that Strategic Alternatives must respond to market changes in a manner that is consistent with the nature of the changes. How do you measure the potential impact of market changes? Two factors can be used to understand impact— permanency and risk.

Permanency

Permanency of the change can be judged along a continuum. The extremes of the continuum are structural and aberrant (Exhibit 4-1). Structural changes reflect permanent changes in the marketplace. These changes may cause a company to reshape its strategy. An illustration of a structural change is the globalization of the U.S. economy. Globalization of markets has forced companies to rethink their business models. Companies have changed the way they do business to accommodate customers from different countries.

Exhibit 4-1: Permanency of change.

Aberrant changes are short-lived in nature. Short-term spikes in interest rates are examples of aberrant changes. Short-term changes can be accommodated by modifications in the resource structure of the company such as short-term joint ventures to accommodate demand.

Risk

If the economic data indicates that your firm's value will decline or not grow as forecasted, a risk has been identified. The risks to the viability of the business will gauge a company's response to economic issues. If the risk is high, a company must respond by strategic repositioning. For example, significant declines in prices may portend overheated competition in a particular marketplace. Is this a structural change in the pricing dynamics of the marketplace? Is the market becoming more volatile? Will this lead to long-term erosion of profits and shareholder value? If the answer to the majority of these questions is yes, then choosing Strategic Alternatives that change your company's market position is appropriate. This may call for an overhaul of your business model, or an acquisition of competitors.

Strategic Alternatives that overcompensate for change will destroy value. A drastic change to a business model may be costly and difficult to implement. Dedication to attainable and forward-thinking goals creates competitive advantages. New initiatives need to be realistic and require careful coordination with the strategic, financial, and operating plans. Since competitive advantages are not permanent, how long will the advantage exist?

|

EAN: 2147483647

Pages: 117