MANUFACTURING VERTICALS

Manufacturing verticals represent great diversity and opportunity for the adoption of Web services. For example, high-velocity industries such as electronics tend to have complex supply chains and high product obsolescence. This demands an intense focus on supply-chain execution and visibility across the entire industry. Conversely, while low-velocity industries such as aerospace and defense do not suffer from high-velocity or product obsolescence, they do need to manage extremely complex design and manufacturing requirements as well as a large number of suppliers.

The following section examines common activities that impact all manufacturing organizations, then examines selected manufacturing verticals for Web services potential.

Common Manufacturing Activities

For all manufacturing verticals there are a number of common activities that can be considered. These include:

-

Supply Chain Management

-

Supply chain visibility

-

Capacity planning

-

Production scheduling

-

-

Product Development

-

Product obsolescence

-

Product development cycles

-

-

Collaboration

-

Customer self-service portals

-

Supplier self-service portals

-

Designing portals to facilitate product development

-

To accomplish these initiatives, a combination of internal integration and collaboration is required. The following sections examine how manufacturers can achieve these goals using Web services.

Supply Chain Management SCM provides ample opportunities where Web services can be leveraged to drive significant changes in the ways organizations procure materials and services, transform them with value-added manufacturing processes, and ship them to customers and trading partners. There are several places in a manufacturing value chain where Web services not only make sense, but can dramatically change the value equation for a company.

Supply Chain Visibility First, supply chain visibility can be enhanced for all participants in an industry by sharing forecast and inventory data at both ends of the supply chain—buy side and sell side. In order to share data, manufacturing firms must tackle the internal integration problem first. This means vertically integrating in-plant manufacturing systems with inplant Enterprise Resource Planning (ERP) systems and then tying multi-site ERP solutions to ERP and financial reporting systems. This scenario is not uncommon, as many large manufacturers have grown through Mergers and Acquisitions ( M&A) and therefore have a variety of ERP and manufacturing systems running across multiple sites. In many cases, where the organization has several different product lines, different ERP systems are more appropriate for specific modes of manufacturing. Process manufacturing and discrete manufacturing, for example, are often handled by different ERP platforms.

In order to obtain accurate information from all manufacturing sites, it is necessary to tie all the plants into a single, real-time view of the total capacity of the organization as well as a single view of all inventory levels, customer orders, and inbound supplies. This information helps avoid stock outages of critical incoming raw materials, provides global visibility to all inventory and customer orders, and ensures steady throughput of customer orders through all manufacturing locations.

Capacity Planning Capacity planning is a very interesting potential application of Web services to vertically integrate manufacturing facilities into business planning systems. For example, Applied Micro Devices (AMD) uses Web services to aggregate data from multiple wafer fabrication tools in multiple plants to obtain a real-time view of its capacity (from fabrication tools, from Manufacturing Execution Systems (MES), from ERP systems, and so on). This type of vertical integration is increasingly used to aggregate manufacturing information to provide real-time production scheduling, global capacity management, and order status reporting. Similarly, Dell manages its manufacturing facilities in real time by publishing a refreshed manufacturing schedule to each of its production plants and partners every two hours. This improves the responsiveness of its supply chain in support of its direct order business model.

Customer Self Service It is increasingly common in manufacturing organizations to integrate Customer Relationship Management (CRM) with ERP platforms and order entry systems, which enables customer service professionals to access all customer orders and obtain real-time updates on order status, shipment location, purchase order status, and more. Increasingly, this level of integration is being used to support customer self-service applications along with customer service operations.

Web services provide a great advantage for these kinds of integration efforts because these connections do not have to be tightly integrated to one another. A Web service could be created for extracting inventory levels, customer order status, and shipment status without using heavy EAI integration schemes. This represents low-hanging fruit for achieving business value from implementation of Web services in manufacturing organizations.

Product Development Increasingly, companies are seeking competitive advantage by streamlining design processes and launching new products faster. In many high-velocity industries, the window of competitive advantage at the product level is narrow, and the obsolescence of components and finished goods is high. This rate of obsolescence puts extreme pressure on design groups to rapidly develop and release new products to production facilities without a glitch.

Web services can be leveraged to support processes such as Engineering Change Notifications (ECNs) and manufacturing effectivity dates for new components, sub-assemblies, or entirely new designs. These critical processes have a tremendous impact on the transition from design to production. These are simple examples of how leading organizations are adopting Web services for internal integration efforts in support of very real business problems.

Once the internal integration hurdles have been overcome with early implementations of Web services, many adopters will experiment with collaboration applications.

Collaboration Historically, collaboration efforts have been unsuccessful due to system integration issues. This was true where firms used a single vendor’s suite of products, and was compounded when using SCM and ERP systems from different vendors. A best-of-breed approach for packaged software implementation often necessitated complex and expensive EAI projects to allow systems to interoperate. Web services will remove the integration barriers and enable seamless collaboration as organizations complete their internal integration efforts, and as ERP and SCM vendors provide open Web services interfaces for their systems.

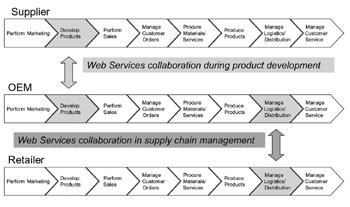

Business models can benefit tremendously from value chain linking and synchronization using Web services. Firms have the potential to achieve these benefits by collaborating along a number of business process dimensions. Figure 5.5 shows how Web services might be applied across multiple value chains, from a supplier to an Original Equipment Manufacturer (OEM) to a retailer.

Figure 5.5 is an example of how value chains might be linked and synchronized across companies and vertical markets. Through the use of Web services, firms will be able to build inexpensive links between their SCM systems, from ERP systems and advanced planning and scheduling, to warehouse management and logistics systems.

Figure 5.5: Web services in collaboration.

Collaboration can produce results in a number of ways, such as optimizing supply chain throughput, improving time to market for new products, reducing inventory levels, streamlining procurement processes, and sharing information with trading partners. In the Web services adoption model, we have shown how collaboration follows internal integration. Once organizations have achieved a level of integration mastery with Web services, they will begin collaborating with close trading partners over secure private networks.

The standards and technologies for security, workflow, and related Web services functions are not yet mature enough to permit extensive collaboration across open networks. However, early adopters of Web services are already well down the collaboration path, as with the Dell Computer example discussed in Chapter 3, “Web Services Adoption.” There are many cases where Web services collaboration can facilitate improved supply chain performance through shared information with partners.

Forecasting and planning are obvious areas for collaboration between organizations, and these were the early targets for B2B integration prior to Web services. On the buy side, customer collaboration for forecasting and orders helps provide more accurate demand information as an input to the Manufacturing Resources Planning (MRP) modules of ERP systems. In electronics, for example, Web services might be used to send requests to channel partners such as distributors, contract manufacturers, and customers for updated forecasts and replenishment orders. This information might then be used by advanced planning systems to calculate an accurate forecast. Even small improvements on the customer-facing side of the forecasting and planning process can produce dramatic results on the supplier side of the supply chain, improving procurement processes and reducing inventory levels.

Supplier collaboration may operate in a similar fashion, with Web service-requests being sent to trading partners, or the reverse, partners may automatically send their updated forecasts and purchase orders to the OEMs. This scenario will again result in streamlined purchasing processes, reduced inventory levels, and fewer stock-outs of critical components required for manufacturing.

Selected Manufacturing Verticals

The following sections review sampling of manufacturing verticals to examine how Web services might impact them based on the industry adoption framework described earlier. The focus for these discussions will be the first two phases of the Web services adoption model, integration and collaboration.

Computers and Electronics Many companies in the computer and electronics industry will likely be early adopters of Web services for internal integration in support of SCM initiatives. This is critical because of the velocity of this industry and the associated rate of product obsolescence. Tight management of inventory through increased visibility of global capacity, inventory levels, customer orders, and inbound components can mean the difference between being profitable and losing money. Razor-thin margins on computers and electronics, as well as rapid price erosion of electronics in general, require superior visibility and control of all elements of SCM and execution.

This scenario, as exemplified by Dell Computer, can become a critical source of competitive advantage. Internal integration, combined with the increased use of collaboration with trading partners, will continue to drive industry performance and individual business results as Web services allow organizations to conduct more complex collaboration initiatives. The following is a brief summary of integration and collaboration opportunities in the computer and electronics industry:

-

Integration —Solving the integration problems in electronics manufacturing using Web services greatly enhances SCM initiatives and visibility of orders, inventory, and potential shortages of key components and materials. Many electronics firms, especially in electronics assembly and contract manufacturing, have grown through M&A, and therefore have very different in-plant manufacturing systems that must be tied into business planning systems. In these situations, Web services can be used to integrate business systems to diverse distributed manufacturing systems by using standards-based XML/SOAP interfaces.

-

Collaboration —Electronics manufacturers in general have already experimented with collaboration systems provided by their SCM software vendors. Web services will drive deeper adoption of collaboration across the entire electronics value chain as integration issues are resolved. Sell-side collaboration with contract manufacturers, distributors, and direct customers can demand multiple interfaces to forecasting and planning systems. Buy-side collaboration can dictate the same number and types of interfaces with distribution centers, suppliers and contract manufacturers for inventory information, forecasts, purchase orders, supplier evaluations, quality information, and more. Web services will reduce the costs of collaboration and will enable the electronics industry to dramatically expand the role of collaboration.

Automotive The automotive industry is ripe for Web services adoption in both the integration phase and the collaboration phase. GM, Ford, and Daimler-Chrysler (and most other global automobile organizations) have widely distributed manufacturing operations, and have retained much of their vertical integration with internal component and subassembly operations. In order to improve supply chain efficiency, Web services can be used to enhance internal integration within individual operations as well as to the corporate headquarters. The following is a brief summary of integration and collaboration opportunities in the automotive industry:

-

Integration —Web services can be used in a variety of integration situations, both internally in assembly operations, as well as in managing global capacity, inventory levels, and sales information at the dealerships. Consider an assembly plant example, where components proceed through three broad manufacturing processes: body shop, paint shop, and general assembly. In the body shop, sheet metal parts are stamped, pressed, and bent, then ultimately welded together into the body of the vehicle (called the body-in-white). There are many tracking systems used to manage the scheduling process through the body shop as a vehicle proceeds to the paint shop. In the paint shop, there are different systems used to manage the routing of vehicles through paint booths based on the type of painting operation in the plant—in-line paint line or modular paint shop with robotics. In either case, there are complex scheduling algorithms used to determine the optimal sequence of vehicles as well as the color sequence used. Once a vehicle exits the paint shop, there are often re-sequencing systems that sort the vehicles to optimize the build schedule in the general assembly part of the plant. This is where the trim, electronics, engines, seats, and other components are added to produce a finished vehicle. The variety of systems required to support automotive assembly, as well as the delivery of components just in time to the manufacturing process, would benefit greatly from Web services. Broadcasts to suppliers for schedule changes, material pull signals, and other SCM systems could be managed using Web services as opposed to rigid, point-to-point integration using proprietary integration mechanisms.

-

Collaboration —The automotive industry will also benefit from Web services in collaboration, especially given the complex network of suppliers to the automotive industry. The network of automotive suppliers, from large tier-one suppliers to medium tier-two suppliers and, ultimately, to the small tier-three suppliers, could use Web services as a common interfacing mechanism for inventory management, purchase orders, forecasting, and even logistics and shipment tracking purposes. Web services will be very powerful in this case because the smaller suppliers cannot afford the infrastructure of EDI. Web services can provide a way for smaller suppliers to exchange EDI-like transactions without having to invest in expensive EDI solutions. In addition, participating in exchanges such as Covisnt, the auto industry’s procurement trade exchange, might be performed using standard Web services as opposed to implementing proprietary huband-spoke e-Commerce integration technologies to connect ERP systems to these exchanges.

Pharmaceutical The pharmaceutical industry is characterized by tremendous R&D expenditures and a high rate of M&A activity. Pharmaceutical organizations maintain an army of sales representatives to sell their products to hospitals and doctors around the world. There are several areas where Web services can deliver value to these organizations. They include the supply chain opportunities we have discussed already, but there are other unique requirements of the pharmaceutical industry that can also benefit from the adoption of Web services. The pharmaceutical industry has similar requirements to other manufacturing verticals in the integration and collaboration phases, but also has its own unique requirements:

-

Integration —The pharmaceutical industry can benefit from Web services in integrating results from clinical trials into their reporting systems as mandated by the federal government, particularly the Food and Drug Administration (FDA). Web services can facilitate the integration of the multitude of systems across the entire new drug development and clinical trial process, as well as shortening the time for approvals. Another integration area for pharmaceutical organizations is in integrating acquired organizations into the parent organization. It is very likely that the acquired organization has different IT applications than the acquiring organization, and therefore, using Web services as the integration mechanism makes sense.

-

Collaboration —Pharmaceutical organizations will adopt Web services for collaboration initiatives supporting drug research. The tremendous cost of R&D for these organizations, as well as the time required to develop new drugs, submit them for approval to the FDA, and move them through clinical trials to final approval is long and arduous. Web services can support collaboration research among organizations working together, which might help defray the cost of new drug development.

Retail/Consumer Packaged Goods (CPG) The retail and CPG industry poses tremendous opportunity for Web services. The CPG industry uses the Collaborative Planning, Forecasting, and Replenishment (CPFR) standard to manage the flow of goods from UEMs to retailers. CPFR will require Web services integration activities within the organization, as well as the collaboration activities similar to those discussed for the electronics industry. Both of these verticals have complex supply chains as well as very complex information systems. Their IT architectures will make use of Web services as an integration technology to expose back-end forecasting systems, inventory management systems, and logistics systems.

The retail industry can benefit from Web services in a number of ways, most notably in supply chain visibility, logistics, and transportation management. Linking Point-Of-Sale (POS) systems with replenishment systems provides real-time information about demand in stores, which enables retailers like Wal-Mart to re-route shipments from regional distribution centers to those stores with the greatest need for replenishment. This is one example of how Web services can be used to integrate highly distributed and disparate systems together in real-time to drive improved business performance. Integration and collaboration in the CPG industries are briefly examined below:

-

Integration —Web services will support CPFR initiatives by helping retailers expose multiple back-end systems to logistics services providers, warehouses/distribution centers, and Third-Party Logistics Providers (3PLs). In addition, linking POS systems to forecasting and replenishment systems will improve supply chain response and help manage inventory across the logistics network. This integration problem is ripe for Web services.

-

Collaboration —Along with CPFR initiatives, which are the primary driver in retail and CPG, Web services can provide collaboration benefits by sharing data among suppliers and with other trading partners, which will accelerate supply chain responsiveness.

Aerospace and Defense Aerospace and defense industries have SCM issues similar to all other manufacturing organizations. The complexity of the products, however, which are engineered to order, demands closer relationships with suppliers as well as with internal engineering organizations to support this mode of manufacturing. Aircraft manufacturing requires significant access to design data such as specifications, Computer Aided Design (CAD) and Computer Aided Manufacturing (CAM) data, and supporting product documentation. Managing the Bill Of Materials (BOM) for an aircraft is no small task, and coordinating suppliers across the supply chain can be extremely challenging. Although supply chain velocity is nowhere near that of the electronics industry, the complexity and sheer number of components is daunting, as are the systems required to manage the design and manufacturing processes. The following is a brief summary of integration and collaboration opportunities in the aerospace and defense industries:

-

Integration —Web services in aerospace and defense will be used to tie internal design and manufacturing systems together, facilitating coordination between the army of suppliers. Again, although the supply chain does not have the same high-speed as some other industries, it is nonetheless complex, and therefore any efficiency gains will enable reduced costs and manufacturing cycle times. The internal integration challenge of aerospace and defense is similar to that of other manufacturing industries, where ERP, CRM, and SCM systems must be linked to provide a cohesive, real-time view of production status, inventory levels, and engineering changes.

-

Collaboration —Web services will facilitate collaboration in aerospace and defense for internal purposes, as well as with suppliers and design partners. Many of these products are engineered products, which necessitates a close relationship between the suppliers, the design organizations, and the assembly operations. Collaboration via Web services will greatly enhance the ability of these organizations to cooperate in the design and manufacture of complex products such as military vehicles, missiles, jets, and other products. Collaboration via Web services will help speed up the workflow of the design cycle, as well as speed up manufacturing, all while reducing the inventory levels across this complex and costly supply chain.

Manufacturing Conclusions

Manufacturing organizations across the board will implement Web services to solve various business problems. While there are common themes across all manufacturing verticals, such as SCM and inventory visibility, the nuances of each particular vertical inevitably places demands on their systems, architectures, and application portfolios that Web services can ease. In particular, the complexity of internal system integration, combined with the increasing service levels demanded by customers, means that integration of disparate systems is critical for enhancing the customer experience and providing internal productivity and cost reductions.

While Web services cannot yet solve all of the problems of these verticals, they can facilitate the sharing of information internally as well as with trading partners, suppliers, and especially with customers. As Web services evolve and collaboration and workflow standards emerge, the attainable business benefits will become greater, and the pace of Web services adoption will accelerate.

EAN: 2147483647

Pages: 90