The Triangle: Three Strategic Options

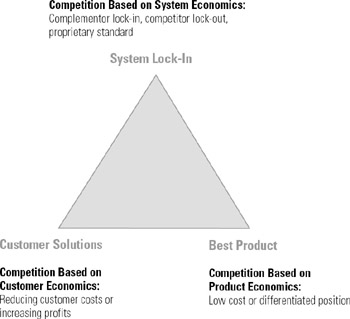

Our research gave rise to a new business model, the "triangle", that better reflects the many ways to compete in the current economy (see figure 8.1). The new model fills a significant void in the development of strategic thinking by offering three potential options: best product, customer solutions, and system lock-in.

Figure 8.1: The Triangle: Three Distinct Strategic Options

The best-product strategic option is built on the classic forms of competition through low cost or differentiation. Its relevant economic drivers are centered on a product or service. A company can achieve cost leadership by aggressively pursuing economies of scale, product and process simplification, and significant product market share that allow it to exploit experience and learning effects. A company can differentiate by enhancing product attributes in a way that adds value for the customer. It can achieve this differentiation through technology, brand image, additional features, or special services. Every strategic option searches for a way to bond with the customer, which is reflected in a significant switching cost. Through the bestproduct option, companies bond with customers through the intrinsic superiority of their product or service. Important aids for this purpose are introducing products rapidly, being first to market, and establishing a so-called dominant design.[2]

The customer solutions strategic option is based on a wider offering of products and services that satisfies most if not all the customer's needs. The focus here is on the customer's economics, rather than the product's economics. A company might offer a broad bundle of products and services that is targeted and customized to a specific customer's needs. In that respect, the most relevant performance measurement of this option is customer market share. Customer bonding, obtained through close proximity to the client, allows a company to anticipate needs and work jointly to develop new products. Bonding is enhanced by learning and customization. Learning has a dual effect: The investment the customer makes in learning how to use a product or service can constitute a significant switching cost, while learning about customer needs will increase the company's ability to satisfy his or her requirements. Both have a positive impact in the final bonding relationship. Often this strategic option calls for the development of partnerships and alliances, which could include other suppliers, competitors, and customers linked by their ability to complement a customer offering.

The system lock-in strategic option has the widest possible scope. Instead of narrowly focusing on the product or the customer, the company considers all the meaningful players in the system that contribute to the creation of economic value. In this strategic position, bonding plays its most influential role. The company is particularly concerned with nurturing, attracting, and retaining so-called "complementors",[3] along with the normal industry participants. (A complementor is not a competitor but a provider of products and services that enhance a company's offering.) Typical examples include computer hardware and software producers; high-fidelity equipment manufacturers and CD providers; TV set, video recorder, and videocassette makers; and producers of telephone handsets and telecom networks. The critical issue here is looking at the overall architecture of the system: How can a company gain complementors' share in order to lock out competitors and lock in customers? The epitome of this position is achieving the de facto proprietary standard.

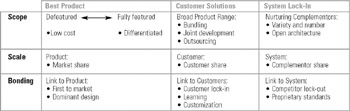

Although, in reality, these options are not mutually exclusive, and a business could decide on a blended strategy, it is useful to consider the three alternatives as distinct ways of competing, with different scope, scale, and bonding (see figure 8.2). The scope significantly increases as we move from best product to system lock-in. At the extreme end of the best-product position, where a company often opts for low cost, the scope is trimmed to a minimum. The scope expands to include product features as a company moves to a differentiated best-product position. It further expands beyond the product to include the customer's activities in the case of customer solutions. The company finally reaches the broadest possible scope as a system lock-in company when it includes complementors.

Figure 8.2: Characteristics of Three Options for Strategic Positioning

Scale is a critical strategic factor typically measured as product market share, which is appropriate when evaluating a best-product position. In the case of customer solutions, a company must consider its share of a customer's purchases. For a system lock-in position, complementor share is the most crucial consideration.

Ultimately, bonding deals with the forces that link the product or service with the customer. In the best-product option, this is done through the characteristics of the product itself. The customer solutions position achieves this through learning and customization. In the system lock-in position, the utmost bonding mechanism is the proprietary standard, which is a fundamental force in driving profitability and sustainability.

[2]Utterback 1994.

[3]For the concept of complementors, see Brandenburger and B. J. Nalebuff (1996).

EAN: 2147483647

Pages: 214