Micropayment for E-Tailing Systems

|

| < Day Day Up > |

|

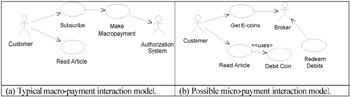

Consider the scenario of customers wanting to browse online newspapers (Dai et al., 2001). Using the typical approach of subscription-based payment, the user would first have to subscribe to the newspaper by supplying personal details and payment details (credit card number, etc.). The newspaper system would then make an electronic debit to pay for their subscription by communicating with an authorization server. The user would then normally go to the newspaper's site where they login with an assigned user name and password. The newspaper looks up their details and provides them access to the current edition if their subscription is still current. If the user's subscription has run out, they must renew this by authorizing a further macro-payment from their credit card. Figure 1(a) outlines the key interaction use cases for this scenario. Problems with this approach are that there is no anonymity for the user (the newspaper system knows exactly who they are and when and what they read), they cannot browse other newspapers without first subscribing to them too, and they must pay for the whole newspaper, even if they want just one or two sections or articles. These issues apply to many other information sources on the Internet where vendors want to charge for content (Blankenhorn, 2001; Herzberg, 1998).

Figure 1: Two Online Newspaper Interaction Scenarios

An alternative approach is to use a "micro-payment" model. There are several approaches to micro-payment (Furche & Wrightson, 1996; Herzberg & Yochai, 1996; Hwang et al., 2001; Manasse, 1995; Rivest & Shamir, 1997; Stern & Vaudenay, 1997). We outline the basic interactions of the NetPay model we have developed (Dai & Grundy, 2002). Figure 1(b) outlines the key interaction use cases for this scenario. The user first goes to a broker and purchases "e-coins" using a single macro-payment. These are stored in an "e-wallet," either on the user's machine or on the broker server. The user can then visit any vendor site they wish, for example an online newspaper. Each time they need to purchase a small-value item, e.g., view an article (or section or page, depending on the item charged for) they give the vendor one or more e-coins of specified value to pay for this service. The vendor redeems these e-coins with the broker (for "real" money) periodically, e.g., each night/week. The user can move to another site and unspent money associated with their e-coin is transferred from the first vendor to the second. If coins run out, the user communicates with the broker and authorizes another macro-payment debit.

The standard macro-payment methods cannot be effectively or efficiently applied for buying inexpensive information goods, like single articles of an online newspaper, because transaction costs are too high (Furche & Wrightson, 1996; Hwang et al., 2001; Domingo-Ferrer & Herrera-Joancomarti, 1999). Encryption mechanisms used are slow and each transaction typically "costs" a few cents. Macro-payment suits spending small numbers of large amounts. In contrast, an Internet micro-payment system allows the spending of large numbers of small amounts of money at websites in exchange for various content or services, as in the e-newspaper scenario above. The design of micro-payment systems is usually quite different from existing macro-payment systems, since micro-payment systems must be very simple, secure, and efficient, with a very low cost per transaction (Dai & Grundy, 2002). This must also be taken into consideration for transaction security: high security leads to high costs and computation time. For micro-payments a lower overall security threshold can be applied. Additional benefits of using a micro-payment approach include preserving the anonymity of the customer—the vendor needs have no information about customers in order to accept their e-coins for service payment.

|

| < Day Day Up > |

|

EAN: 2147483647

Pages: 191

- An Emerging Strategy for E-Business IT Governance

- A View on Knowledge Management: Utilizing a Balanced Scorecard Methodology for Analyzing Knowledge Metrics

- Technical Issues Related to IT Governance Tactics: Product Metrics, Measurements and Process Control

- Managing IT Functions

- Governance Structures for IT in the Health Care Industry