| Asset allocation is very important, and sometimes the slightest change can make a big difference. There are principles that you can use as guidelines when determining and evaluating how you want to allocate your assets or make changes to them. So, how about a little advice from a reputable source to help you out? Don't worry, there's no insider trading going on here, just Quicken's Asset Allocation Guide, which has some great tips. This guide has some very helpful information about assets and asset classes, how to go about allocating your assets, what an ideal portfolio looks like, monitoring your assets, and rebalancing your portfolio. In addition, this guide should be able to answer some of your questions about risks, how to reach your goals, finding a reputable financial advisor, and much more. Get Help with Asset Allocation  From the account bar, click Investing Center. From the account bar, click Investing Center.

Click the Analysis tab. Click the Analysis tab.

Click Show Allocation Guide or you can click the Asset Allocation Guide link in the Analysis Tools box. Click Show Allocation Guide or you can click the Asset Allocation Guide link in the Analysis Tools box.

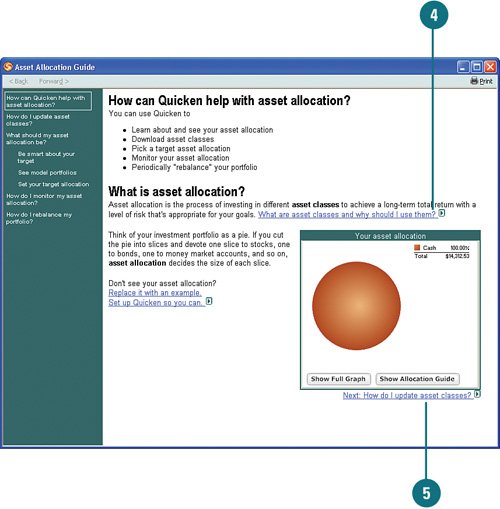

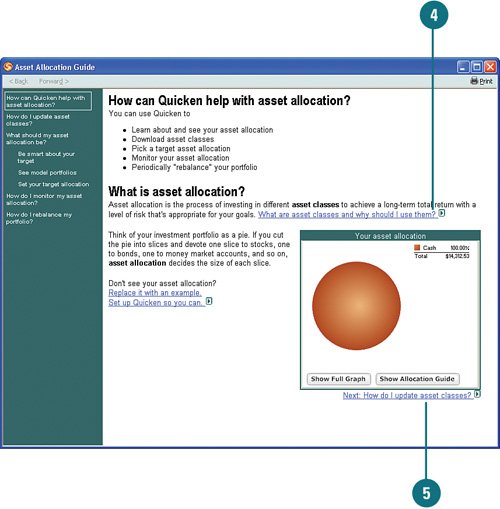

The guide starts with some basic information about assets and a pie chart view of your current asset allocations. For more information about asset classes, click What Are Asset Classes and Why Should I Use Them? The guide starts with some basic information about assets and a pie chart view of your current asset allocations. For more information about asset classes, click What Are Asset Classes and Why Should I Use Them?

To proceed to the next page of the guide, click Next: How Do I Update Asset Classes? You can also use the menu on the left to move through the guide. To proceed to the next page of the guide, click Next: How Do I Update Asset Classes? You can also use the menu on the left to move through the guide.

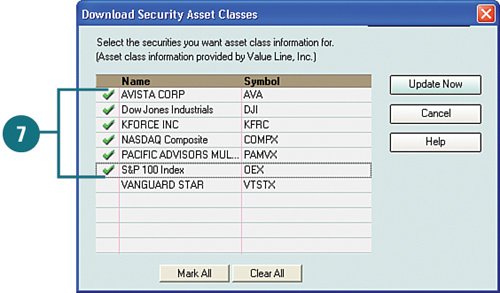

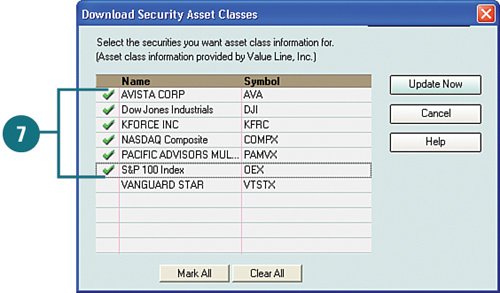

Review the information about updating asset classes and common questions. If you want to download the latest classes, click Go Online and Update Asset Classes. Be sure you are connected to the Internet before proceeding. Review the information about updating asset classes and common questions. If you want to download the latest classes, click Go Online and Update Asset Classes. Be sure you are connected to the Internet before proceeding.

Select the securities for which you want asset class information, and then click Update Now to download the information. Select the securities for which you want asset class information, and then click Update Now to download the information.

To proceed, click Next: What Should My Asset Allocation Be? To proceed, click Next: What Should My Asset Allocation Be?

For Your Information To get additional information about downloading asset classes, click the Common Questions About Downloading Asset Classes link. |

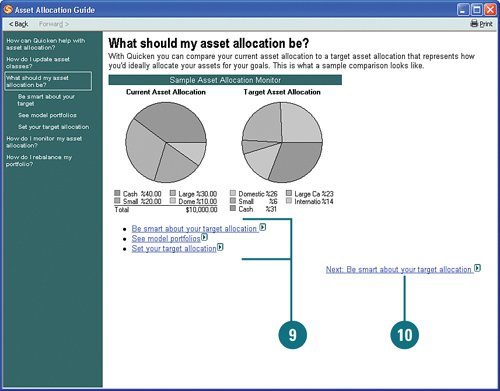

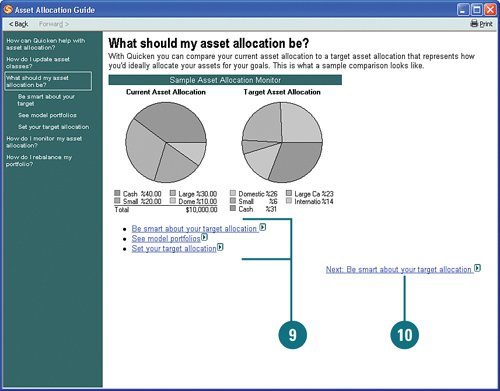

Explore the links to get more information on a subject, or to set up or change information about your allocations, such as your target allocation. Explore the links to get more information on a subject, or to set up or change information about your allocations, such as your target allocation.

Continue to review all the asset allocation information and click the Next: Be Smart About Your Target Allocation link to move to each new page. Continue to review all the asset allocation information and click the Next: Be Smart About Your Target Allocation link to move to each new page.

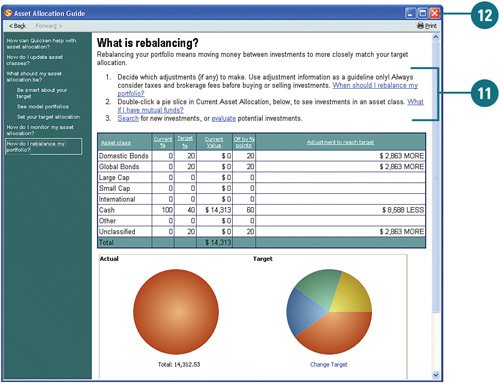

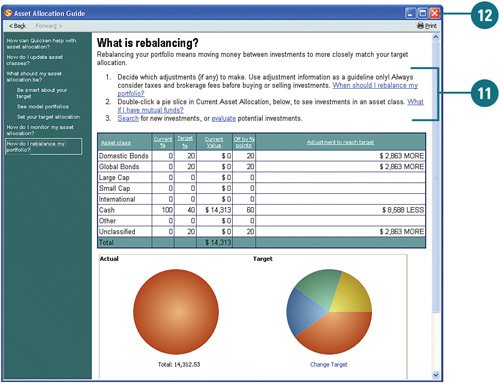

When you reach the last window (titled What Is Rebalancing?), review the steps you need to take to rebalance your portfolio and click the links to get additional information. When you reach the last window (titled What Is Rebalancing?), review the steps you need to take to rebalance your portfolio and click the links to get additional information.

See Also See "Determining Whether You Need to Rebalance Your Portfolio" on page 305 for more information on rebalancing your portfolio. |

When you are finished, close the window. When you are finished, close the window.

|