Rethinking Efficient Replenishment in the Grocery Sector

Phil Whiteoak

ECR a FAD or the Future?

The idea of Efficient Consumer Response (ECR) is sweeping through the board rooms of most fast-moving consumer goods manufacturers and retailers in the advanced economies of the world. The vision of ECR Europe, ‘Working together to fulfil consumer wishes better, faster and at less cost’, is driving a unique initiative by suppliers, distributors and retailers that claims to provide European consumers with the best possible value, service and variety of products through a collaborative approach to improving the supply chain. Debate still rages as to whether ECR is, at best, a philosophy which can genuinely improve consumer value or, at worst, simply a new management fad. Alternatively, it may be seen as a tactic for gaining control in a trading relationship or simply as a toolkit for tinkering with the complex balances of the supply chain. Indeed, in a provocative address to the 39th CIES Annual Executive Congress in Paris in June 1996, Professor Lou Stern of Northwestern University, USA, remarked, ‘ECR is a short-term survival tactic, a mandatory set of tactics which may allow the business to buy time . . . it does not ask the question “How do people really want to shop for food?’’

Rather, it assumes that the answer is the existing supermarket . . . and goes on from there to address value chain logistics.’ He also decried the notion of collaboration: ‘partnership as it’s practised today is manipulation. . . we’ll be partners if it benefits me.’

There is no doubt that today’s grocery markets are intensively competitive. The internationalization of trade and the rapid pace of technological development are creating major challenges, even for well-established businesses. Globally, increasingly sophisticated consumers are driving both manufacturers and retailers into developing extended product ranges and into trading in more countries and distribution channels. These trends tend to dilute traditional economies of scale. Supply chains are becoming longer and more complex as a result of the need for sourcing the materials to support these markets. Environmental legislation, the pressure of reducing cycle times and a focus on customer service are constraining the drive for efficiency and cost reduction. Addressing value chain logistics is thus not to be disparaged and offers the logistics community a worthwhile opportunity to improve its performance within this dynamic environment, notwithstanding other breakthroughs in fulfilling consumer needs, such as home tele-shopping. In any event, there will always remain the need to move goods efficiently from the point of production to the point of consumption. In short, there will always be a ‘supply chain’. In grocery, the opportunity is indeed worthwhile: the retail value of European grocery markets is in excess of €700 billion (1998 prices), with supply chain costs estimated to be around 10 per cent of sales. Small improvements in logistics efficiency across this market can thus generate huge cash savings. The building of a critical mass of businesses that share the vision and that co-operate and exchange information to employ a number of ‘improvement concepts’ is the key to unlocking this benefit.

The improvement concepts within the ECR initiative embrace Category Management (which aims to optimize the range of products stocked in store, the efficiency of promotions and new product introductions), Product Replenishment and Enabling Technologies. Broadly, these address ‘demand side’ and ‘supply side’ activities and the information systems necessary to support them, and consist more or less of a catalogue of techniques and a guide for their application. No single technique is universally effective and, while the application of any one technique may generate benefits for one supply chain player, it may have adverse consequences for the other. This chapter reviews the facts and myths behind current ‘efficient replenishment’ thinking and proposes a supplementary approach to the current practice.

Efficient Replenishment

Both in the United States and in Europe the initial focus of the ECR movement was product replenishment, or, as it has come to be known, Efficient Replenishment. The reasons for this are simple: first, the size of the prize to be won in streamlining grocery supply chains is huge – in the United States it was first estimated that the total grocery supply chain inventory could be reduced from more than 100 days of sales to around 60 days by the application of ER techniques. Although in European supply chains the stock is on average already substantially below the American aspiration, their annual operating costs of €70 billion (1998 prices) offer tempting opportunities. Second, so far, the subject of ER has been relatively non-contentious. Hitherto, it has not figured greatly in trading debates between retailers and their suppliers about range, promotions and profitability and has frequently been left to the logistics functions of either business to resolve.

However, there is now a growing awareness across Europe that ER is a strategic tool for improving margins and reducing cash tied up in working capital. The danger is that the pursuit of these benefits by any one party without consideration of the possible impacts on other players in the supply chain can significantly disturb the balance of costs between manufacturers and retailers. Despite setting out to create a climate of collaboration in which all parties should benefit, the ECR movement may add to this risk of destabilization by promoting a particular technique without adequate explanation of the most appropriate criteria for its application. This idea is explored below.

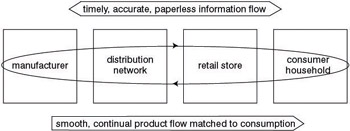

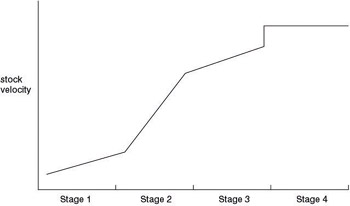

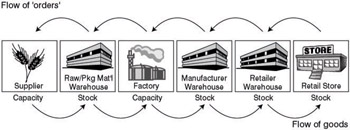

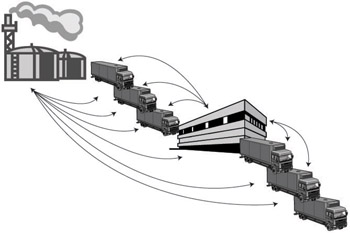

What is efficient replenishment? Figure 8.1 illustrates the concept as a smooth, continual flow of product, matched to consumption and supported by a timely, accurate and paperless information flow.

Figure 8.1: Concept of Efficient Replenishment

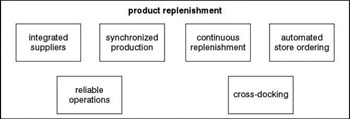

The techniques often described for delivering this vision are illustrated in Figure 8.2. Of these, Continuous Replenishment and Cross- Docking are probably amongst the most frequently discussed, and perhaps the least well understood.

Figure 8.2: Techniques for Efficient Replenishment

Continuous Replenishment Programmes (CRP)

CRP comes in many forms. The most commonly described is Vendor Managed Inventory (VMI) in a Fixed Order Quantity (FOQ) environment. This requires daily review of the retail sales and stock position, with an order only suggested when necessary to meet previously agreed target stocking levels. The replenishment algorithm uses actual retail sales information for forecasting future sales, on the basis of which a new order is calculated. In order to work effectively, this must have Electronic Data Interchange (EDI) communication from the retailer to the supplier and probably needs intervention or examination by the supplier’s customer service department every day.

What is the objective of this sort of CRP? By gaining control of retail replenishment processes a manufacturer aims to manage ordering behaviour towards more efficient load building. The manufacturer is also responsible for managing product availability at the point to which goods are delivered (which presupposes the manufacturer can do this better than the retailer), hence assuring support for his promotional and feature activity and thereby moving towards preferred supplier status. The manufacturer does gain the benefit of market intelligence about sell- through, but overall the information is of little further value unless it can be obtained from a sufficiently large population of customers to enable its use in the modification of sales forecasts and production plans. In any case, this is likely to be most suitable for retail outlets where there are store back-room stocks and where orders are still raised directly on the supplier. It is also suitable for retail regional distribution centres (RDCs) which are responsible for their own replenishment and which are prepared to relinquish control to the supplier. It is most likely to be suitable for lines with large volume sales and forecastable promotional impact.

A variant on this is called Co-Managed Inventory (CMI) where retailers share information about promotional programmes of all suppliers in the category with vendors participating in the scheme. There may well be legal limitations on this under European competition law. In the United Kingdom, there are few applications of this sort of VMI with the major multiple retailers.

VMI may also run in a Fixed Order Cycle (FOC) environment. Typically, this is used to service smaller outlets which are not capable of managing their own inventories well and where it is only cost-effective for a supplier to make a sales call or a delivery weekly or fortnightly at most. In this situation, either the supplier’s representative or merchandiser counts stock or, prompted by a small discount as an incentive, the customer counts it and returns a balance for each stocked product by telephone or fax to the supplier’s office where it is keyed into the VMI system. The movement between the current and previous stock balance is used to calculate the retail sales. Otherwise the mathematics are the same as before. This approach is suitable for use where customers are not sufficiently well-advanced to be able to support EDI connections. The prime aim of this style of application is to be a sales support tool for gaining control of in-store availability to support display and feature selling. Real examples of this exist in the independent wholesale sector. The key elements in the replenishment here are the order review cycle, the replenishment lead time and the target safety stock level.

Both FOQ and FOC VMI systems could also be run by suppliers upstream of grocery product manufacturers to keep factories supplied on a similar basis. There are also some radical approaches now in existence where suppliers are expected to keep factory input buffers full or toppedup with no formal communication of expected requirements.

In the case of the large multiple retailers in the United Kingdom, their aim is very much to run a CRP process in which they retain control of the replenishment (in order only to have to deal with a single uniform process) and move towards a daily call off on very short lead times. This is undoubtedly continuous replenishment but not VMI. However, there are initiatives running in the United Kingdom on joint promotional planning and, although these may be part of a CRP initiative, they are not what is commonly understood to be CRP in the industry.

Very generally, in retailer CRP programmes a number of functions are required: aggregation of store demand (via Automated Store Ordering) to a total demand on an RDC, calculation of the RDC replenishment requirement, conversion of the RDC replenishment need into a supply instruction (sales order process/despatch preparation). These processes need to be carried out regardless of whether they are done by the customer or the supplier. In some applications in the United States, retailers have delegated the responsibility for both store and RDC replenishment to vendors, giving them access to store scanning data. The reason for transferring responsibility for, for example, RDC replenishment from retailer to manufacturer is either about gaining control or demonstrating a mutual advantage. In many cases supply chain partners may not be willing to relinquish control, irrespective of the quality of the case argued.

Cross Docking

Cross-docking is a technique in which goods arriving at an RDC are unloaded from the inbound vehicle and moved from the goods receiving area ‘across the dock’ for marshalling with other goods for onward despatch without being put away into stock. This technique has long been a necessity for very short-life, perishable products. There are broadly two types: full pallet and case level cross-docking. The former is often used in large geographic areas (such as the United States) where a full vehicle of full pallets moves from the production source to a regional cross-dock point. The full pallets are then off-loaded and moved across the dock for consolidation with full pallets from another source to enable the building of a full vehicle load for onward transfer to the final destination, which is likely to be a warehouse local to a number of stores where the full pallets are put away into stock for subsequent let-down, picking and delivery to store. Typically, the picking at this stage is the traditional ‘pick-by-store’ technique.

Case level cross-docking embraces a new concept – pick-by-line to zero. The key elements here are timely delivery and just the right quantity. In this case, there is usually only one move between the manufacturer and the store. At the RDC, lanes are set out containing roll-cages to be delivered to each store served by the RDC. As the goods arrive, they are broken down and the appropriate quantity of each product line is loaded into the roll cages for each store. Full pallets of single products are no longer necessarily appropriate – only the quantity of product required by the stores need be delivered in order to avoid having to put a surplus away into stock. A strategy of pick-by-line cross-docking has obvious appeal to retailers. Not only is working capital freed-up from inventory holding, but also the assets and people required for managing warehouse stocks (put-away, let-down, etc.) are no longer required. These represent approximately 30 per cent of the operating costs of a conventional stockholding retail RDC. Most importantly, though, the freeing-up of buildings previously occupied by racking and stock creates space. This space in turn enables throughput capacity to be created. Thus, from a simple change in supplier delivery behaviour, a retailer can generate significant increases in its capacity to process volume growth in the business without major investment in buildings, plant and equipment.

From a manufacturer’s perspective, the implications of such a change are that it has to be able to supply on short lead times, to support daily review of order requirements, to make deliveries scheduled to meet retailer receiving requirements and, above all, to maintain consistently reliable service levels.

Synchronized Production

This technique aims to match manufacturing production cycles with retail sales and in many batch-oriented packeted grocery production processes remains a pipe dream. Canning, bottling and carton-filling lines are expensive to install and are often used to produce many different finished products. Inherently, they are designed to run in cycles and therefore to ‘make for stock’. Often, too, their upstream supply chains are extended, with material availability constrained by crop yields. To move closer to ‘making to order’ requires clear communication and effective implementation of customer marketing plans to achieve predictable consumer offtake. Retail buying behaviour must be synchronized with offtake levels and there needs to be adequate instantaneous logistics capacity to accommodate the peaks and troughs in demand. This all needs to be allied to shorter manufacturing cycles and run lengths and faster change-overs to support the burgeoning number of product lines necessary to keep pace with increasingly demanding consumers. As order-to-delivery lead times continue to be squeezed by retailers at a rate not matched by corresponding improvements in manufacturing cycle and response times, the possibility of ‘making-to-order’ remains unattainable. The reality in most packeted grocery plants remains that of ‘making-for-stock’. This requires an accurate sales forecast to be made, which, in an environment of increasing promotional activity, continues to be a prerequisite of efficient replenishment.

Notwithstanding these difficulties, it should go without saying that Reliable Operations (that is, the ability to produce the planned product at the right time, at the right quality and in the right quantity) are fundamental to being able to fulfil retail demand reliably and at the minimum level of stock. Integrated Suppliers are part of a concept in which the suppliers of manufacturers are part of the same ‘virtual enterprise’ as the manufacturer. Often they are responsible for keeping factories supplied with materials on a continuous replenishment basis along exactly similar lines to those outlined above for CRP activity between manufacturers and retailers. The idea of integration as a supply chain development tactic is discussed in more detail later.

Supply Chain Types

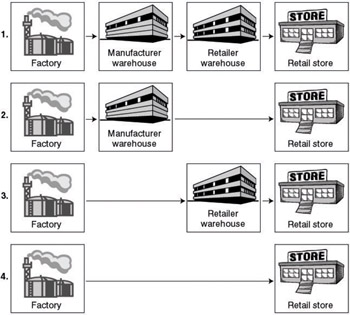

An alternative way of assessing the use of these techniques is to consider the different types of grocery supply chains in which they might be used. Figure 8.3 sets out the four main types which characterize 80 per cent of European grocery supply.

Figure 8.3: Main Types of Grocery Supply Chain

These generally have the following characteristics:

- Make to stock production with RDC delivery.

- Make to stock production with direct store delivery.

- Make to order production with RDC delivery.

- Make to order production with direct store delivery.

The first is the routine method of distribution in the greater part of European grocery markets, typically applicable to large volumes of ambient temperature chain goods, produced in cyclical batch processes, and where retail stores have little or no back-room stock. The second is typically used in less advanced markets, where stores retain stock back- rooms or in markets where large deliveries can be made to very large hypermarkets. The third applies in perishable goods chains where volumes are insufficient for efficient delivery direct to store and a consolidation is necessary in the retail RDC to drive up vehicle utilization. The last also applies in perishable chains, typically where large volume, very short life items are sourced locally for stores (eg milk, bread). Exceptionally, this route may be used for ‘specials’ such as display pallets direct from factory to store.

The key replenishment processes are

- Retail store with automated (computer assisted) store ordering (CAO);

- Retail RDC with Purchase Order Management (POM) based on aggregated store orders;

- Retail RDC with Continuous Replenishment Programmes (CRP) by supplier;

- Supplier warehouse or supplier factory with order processing/ despatch preparation.

Note that even if suppliers undertake CRP, there will remain a need for order processing to convert requests for a delivery into a vehicle despatch and to apply pricing. The only processes which potentially overlap or are duplicated are RDC POM and supplier CRP.

Note also the role of the retail RDC. This may be to hold stock, but is primarily to consolidate store deliveries across a range of suppliers. In the event that the RDC is stockless, then its supply is more likely to be closely coupled with the store CAO, suggesting that vendor-managed CRP is less likely to be attractive to retailers. Retailers will wish to remain in control of store replenishment. Thus CRP programmes are not likely to represent the long-term trade direction.

In summary, retail distribution of ambient goods will in the main be focused through RDCs, not principally via direct store delivery.

These RDCs will continue to destock via lead time reductions and increased order frequency. Suppliers will see the effects of this in smaller, more frequent orders, more order picking and reduced vehicle utilization.

Principles already successfully applied to fresh food and private label distribution will be applied to ambient and frozen branded goods. Stock will only be held in store and will be eliminated in retail RDCs by daily ordering and same-day delivery seven days per week driven by checkout scanning data and significant investment in replenishment systems and technology. Order quantities will no longer be governed by achieving best terms conditions but rather will aim to provide ‘just the right quantity’. Stock at RDCs will be eliminated as products are ‘picked by line’ on arrival, moved ‘across the dock’ and assembled for store delivery. Deliveries to RDCs will therefore be scheduled to optimize RDC resource utilization and to consolidate store delivery transport into fewer vehicles. Ultimately, deliveries arriving at RDCs will be required to have been preassembled into roll-cages. Quality of manufacturer service (in terms of delivery accuracy and timing) will be the key to maintaining product availability in store. This will lead to peaking of picking and vehicle loading activity in manufacturer warehouses (ie more instantaneous spare distribution capacity will be required), ‘real-time’ processing of orders, automatic allocations of stock and more responsive supply systems. Electronic Data Interchange (EDI) will be a prerequisite to enable the achievement of the necessary fast cycle times of the replenishment process. Bar-coded product identification and case marking will be essential to facilitate the automation of goods handling and the elimination of errors. Visibility of stock available to commit becomes essential. There will be no time to replan or redeploy. The role of the manufacturer’s customer service clerk will therefore be much reduced because there will no longer be the opportunity to participate directly in the order management process.

A fundamental strategy for countering such trends will be the use of genuine cost-related price cards which identify and pass on the costs of such added-value servicing arrangements and which promote the type of ordering behaviour better suited to the nature of the manufacturer’s production process. This will enable manufacturers to limit the erosion of their lead times so that the peaking of the requirements for distribution capacity can be smoothed. However, requests to expose manufacturer logistics costs will increasingly become a component of the trading debate. Activity- based costing in the logistics network will thus be the key to price card determination and for providing the information for these discussions.

In parallel there will be a retail focus on the efficiency of vehicle utilization, featuring requests for customer collection, use of consolidators for smaller volume business and pooling with third parties in intermediate warehouses. This will lead to demands for ex-works pricing, cherry- picking of routes by retailers and loss of control of vehicles by suppliers. However, there will be a potential for the creative use of shared fleets to increase vehicle utilization. These practices will be applied to routine replenishment. Exceptionally, different practices and routes to store may be used for special or promotional lines.

Finally, downstream of the supplier warehouse, and from a supplier viewpoint, replenishment consists of two parallel processes. The physical response (ie moving goods through the supply chain) and planning the availability of the appropriate stock. The ECR work to date has tended to focus on the inventory replenishment and ordering processes between manufacturer–retailer pairs and, other than cross-docking, little attention has been paid until now to improving the physical aspects of moving the goods.

Impact of Lead Time Reductions on Manufacturer Inventory Levels

The foregoing discussion identifies areas where manufacturers will need to increase their response capability within the physical distribution network. Will these changes also impact their stock holding? Since, in the main, large producers of packaged goods manufacture in cycles, they will have to continue to manufacture for stock, but the uncontrolled erosion of lead time described above will reduce their opportunity for ‘make-to- order’ production and increase their dependence on sales forecasts to plan cycle stocks to meet the service requirements. Changes in retail physical distribution practice could transfer inventory holding and handling activity upstream to manufacturers and potentially have an adverse impact on the capacity and efficiency of supplier distribution warehouses and transport utilization. Business processes and systems will therefore need to be developed to support parallel activities in fast- cycle operational distribution and the planning and scheduling of the necessary inventory and logistics resources.

However, this analysis relates mainly to developments in large-scale retail grocery. Clearly, the situation in other channels is varied and dynamically changing. The logistics networks manufacturers provide must be able to adapt to the needs of these other channels as well as providing the capacity to respond to the grocery trends.

Most packeted goods manufacturers are primarily ‘make-for-stock’ organizations. Generally, customer order-to-delivery lead times are already less than production cycle times and, broadly, further reductions in delivery lead time will not materially affect cycle stocks. However, as lead times are reduced, the ‘actual’ component of immediate future sales (the order bank) is also reduced, increasing the forecast component. Therefore, the element of safety stock which covers forecast accuracy is likely to increase.

Manufacturer programmes for stock reduction must therefore hinge on reducing cycle times and improving forecast accuracy. Cycle times are determined by the following:

- economic run lengths (a trade-off of material batch efficiencies with changeover and downtime costs, together with achievable line output rates thus determines the amount to be made in one run);

- rate of sale (determining how often this amount should be made);

- available line capacity.

Militating against shorter run lengths are loss of capacity through downtime, increased costs due to changeovers and reduced efficiency. However, increasing range complexity within a fixed plant configuration will demand shorter run lengths and thus more frequent cycles.

A branded product manufacturer has to supply many different channels and individual retailers. The manufacturer must therefore balance capacity across a multiplicity of customers and thus efficient consumer response with an individual customer cannot extend into the daily scheduling of production.

The Branded Manufacturer s Response

Manufacturers are already beginning to provide support for these fast cycle requirements by increasing the capacity and efficiency of their distribution networks and by providing new order management systems. However, these only provide the capability to deliver more efficiently whatever stock is available. Manufacturers therefore also need to provide support for improved planning processes to assure supply availability to meet customer service performance targets and to establish lowest target stock levels to achieve this service level. This has to be achieved whilst making the appropriate trade-offs with manufacturing and supply chain operating costs.

This suggests a number of information strategies as shown in Table 8.1.

|

Objective |

Strategy |

|---|---|

|

to improve in-market forecasting |

customer-level activity management and joint forecasting initiatives based on point of sale, data; category |

|

to improve efficiency of transport |

develop new approaches to shared transport management |

|

to improve factory scheduling |

implementation of Master Production Scheduling (MPS) and Manufacturing Resource Planning (MRP) programmes (these address having the right stock in total although not necessarily in the right place) |

|

to improve in-market stock deployment |

implementation of Distribution Requirements Planning (DRP) systems; use of vendor-managed CRP programmes |

|

to improve financial processes |

use of Electronic Funds Transfer techniques |

|

to improve administrative efficiency |

development of new EDI transactions (eg confirmation of proof of delivery); use EDI price or promotion databases; adoption of ‘green lane’ delivery arrangements (no checking of supplier deliveries at retail RDGs) |

Supply Chain Integration

Supply chain integration between trading partners is often cited as an essential technique to achieve improvements in the efficiency of the replenishment processes. It is important to understand what is meant by the concept – integration can be a technique for aiding optimization of the supply chain but it can also be a means whereby one participant in the chain gains control over a greater part of the chain. So far, the integration activity reported in the ECR literature has been mainly focused on execution level processes, typically operating between manufacturer and retailer pairs, or along the chain. For example, the principal techniques described are CRP and cross-docking. Few examples have been seen of across the chain integration and there has certainly been little evidence of integrated planning. Now, given that one manufacturer supplies many customers and one customer is supplied by many manufacturers, the idea of considering the replenishment process in this context as a chain is erroneous. Supply chains are in fact supply networks in which complexity is increasing rapidly.

So far, improvements in efficiency have come from the application of techniques, none of which is universally beneficial. Integration along a chain is a technique to enable one partner to gain control; integration across the network will help overall optimization. Some consequences of ‘along the chain’ integration are considered below.

Consequences of Along the Chain Integration

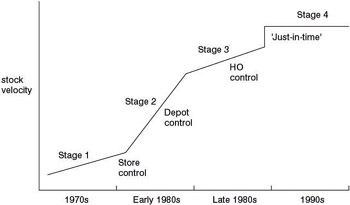

Figure 8.4 illustrates the evolution of UK retail grocery distribution practice. The x-axis of the graph considers the period of time since the 1970s. The y-axis uses as its measure of efficiency the rate of retail inventory turn.

Figure 8.4: Evolution of UK Grocery Distribution

Over the last 20 years or so there have been four stages in this evolutionary process. The first, ‘Store Control’, typical during the 1970s, is characterized by direct delivery from manufacturers to stores, with store inventory levels controlled by the branch manager, often ‘assisted’ by the manufacturer’s representative. Usually, one order was placed each week on a week’s delivery lead time, with up to five weeks’ stock held in store. Improvements in inventory turnover during this period were relatively slight. The second stage, ‘Depot Control’, saw the RDCs. Generally, orders were still taken on a weekly basis, but there were several deliveries made each week, and lead times were beginning to edge down. Stock levels were significantly reduced by this centralization process. The RDCs still operated on a put-away and let-down basis, with order pickers touring the picking face to assemble complete orders for branches on a pick-by-store basis. This period also saw the increasing introduction of computerized branch replenishment systems.

establishment of retail RDCs in the early 1980s and the gradual transfer of stock and stock control from stores to the

In the third stage, ‘Head Office Control’, the control of replenishment was transferred from the RDCs to retail head offices, with further increases in order review frequency and reductions in lead time. Stock in the system fell further, to between one and three weeks. A further innovation was the initial introduction of ordering based on data obtained from the checkout scanners. The new concept of composite, multi- temperature storage and distribution began to appear.

In the United Kingdom, retail grocers are already in the final stage, ‘Just-In-Time’, for perishable goods and are fast moving there for frozen and non-perishable packaged grocery products. Here, there can only be a final step change as RDC stock is reduced to the minimum to support pick-by-line cross-docking. The features of this phase are the extension of the composite networks supported by accurately-timed, daily deliveries on very short lead times.

In summary, the period of this overall evolution features a centralization of warehousing, inventories and inventory control, coupled with a trend towards advanced JIT replenishment methods, supported by massive retail investments in information technology support.

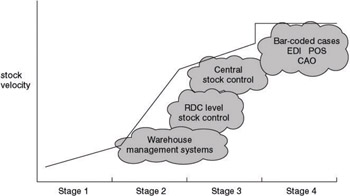

By transferring the four stages of development to the x-axis, a generalized picture of distribution evolution may be obtained (see Figure 8.5). The state of development of a market in general or an individual retailer in particular may be mapped on to this model by positioning it at the appropriate stage. However, fundamental to progress up this curve is the presence or absence of a number of the enabling technologies illustrated in Figure 8.6.

Figure 8.5: Distribution Evolution

Figure 8.6: Prerequisite ‘Enabling’ Technologies

In order to move from Stage 1 to Stage 2 and operate via an RDC, it is necessary for the RDC to have some sort of warehouse management system. For the inventory to be controlled at the RDC, an RDC level stock control needs to be introduced. The centralization of the control of inventories at Head Office requires central visibility of RDC stocks and a process and system for managing them. To progress effectively to Stage 4, a retailer ideally needs the goods received to be bar-coded with the appropriate identifiers, as well as a computerized point-of-sale data capture system and computer-assisted store ordering processes. For the communications to work effectively, EDI links have to be established with suppliers. The significance of this simple model is that the enabling technologies up to the end of Stage 3 require only implementation by the retailer. There is no impact on the manufacturer. However, in order for a retailer to implement EDI and to scan bar-coded cases, its suppliers have to modify their own systems and processes to conform to these new requirements. This is a case of integration ‘forced’ on to a manufacturer as a requirement for doing business.

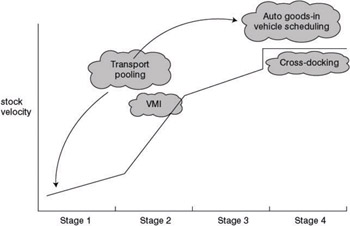

Another aspect of this evolution of replenishment processes is the concept of ‘opportunity’ technologies which can be introduced at various stages of the development curve. Figure 8.7 illustrates this. Here it may be seen that Vendor Managed Inventory offers an opportunity for retailers still at Stage 2 in the evolution curve. Technologies such as cross-docking and automated goods-in vehicle scheduling at retail RDCs are increasingly propounded as methods of further driving down costs. However, each of these approaches demands a systems and business process change on the part of the other players in the supply chain. These will certainly generate one-off implementation costs and quite likely ongoing operational cost increases for one partner which will not always outweigh the overall benefit, even though the initiator of the change may himself gain. These are further examples of integration as a means of gaining control or driving benefits for one party only.

Figure 8.7: Opportunity Technologies Transport Policy

Example of Across the Chain Integration

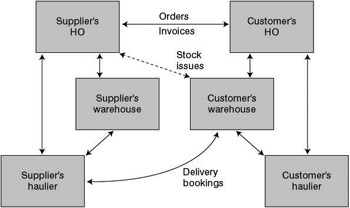

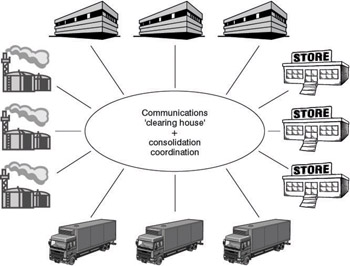

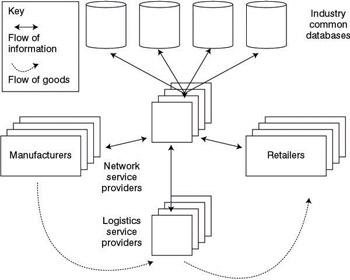

However, an example of an opportunity technology which can offer benefits across the whole of the evolution curve is transport pooling (see Figure 8.7), although this has to be based on cross-sectoral collaboration in which the day-to-day management is vested in disinterested third parties, rather than vested in any one supply chain partner. This is explored further below. Figures 8.8 to 8.13 illustrate the concept. In simple terms the supply chain is often viewed as a flow of information and goods between suppliers and retailers (Figure 8.8). In reality, there are many third parties involved in the chain, notably many separate transport and warehousing operators (Figure 8.9). On the basis that the use of opportunity technologies such as transport pooling derives greater benefit from a larger number of participants, then there are likely to be at least as many opportunities for consolidation across many supply chains as there are along single ones. Here, across the chain integration affords a genuine chance of optimization (Figure 8.10). However, complex communications and the absence of standards inhibit the achievement of synergy opportunities (Figure 8.11). For example, Figure 8.12 illustrates the communication flows that take place between the parties involved. In addition to the routine exchange of orders and invoice data between the supplier and customer head offices and, potentially, the exchange of warehouse stocks and issues data in a CRP relationship, there are many instructions issued between both the supplier and retailer and their logistics operators – transport movement instructions, warehouse order picking and assembly instructions, etc. Further, each haulier may have to make collection and delivery bookings at each warehouse. These instructions are not often issued in any sort of industry standard format, nor are they visible to other parties. The opportunity for improving synergy must stem from simplifying and standardizing these communications, using a third party added-value network service to act as a communications clearing house and a consolidation coordinator (Figure 8.13).

Figure 8.8: Supply Chain Characteristics

Figure 8.9: Networks of Third Parties

Figure 8.10: Consolidation Opportunities Along and Across Many Supply Chains

Figure 8.11: Complex Communications Via an Added-Value Network Service

Figure 8.12: Replenishment Interfaces

Figure 8.13: Simplified Communications Via an Added-Value Network Service

Integration across the chain is thus about integrating replenishment processes with the other parties involved, such as transport and ware- housing suppliers, and communicating with them via electronic means. This integration needs to address what processes should be included, what should be communicated, with whom, when, how and why, and how the activity should be organized to optimize its efficiency together with what new software and services will be needed to facilitate this way of working.

Facilitating Across the Chain Integration

Current grocery industry logistics thinking across Europe is increasingly dominated by activity in ECR. Much of this is now retailer-led and, as is evident from the foregoing analysis, not always in the best interests of manufacturers. There are four principles which should drive logistics development and ECR. These should aim to do the following:

- To reduce total supply chain costs.

- To enhance consumer value and community benefit.

- To obtain an equitable division of any benefits resulting from change.

- To maintain a fair balance of control in the supply chain.

The thesis explored above is that growing retailer power and significant retailing developments in internationalization, new store formats, own label, information technology and distribution are characterized by a trend towards not only centralization of control of their own supply chains by retailers but also attempts to acquire greater control over manufacturer supply logistics. Retailers are currently driving supply chain development towards their own goals and not always in the interests of the above principles. Their initiatives are sometimes detrimental to the interests of branded manufacturers (current ‘best practice’ ideas such as more frequent deliveries, cross-docking and pick by line are not necessarily in the best interests of the principals). There is a clear danger of transfer of control downstream and transfer of costs upstream. This situation may be redressed through promoting awareness of the real consequences and developing new initiatives rather than trying to redirect existing ones such as ECR. Hence there is a need to develop new initiatives in cost-effective distribution to the consumer. This can best be managed via a new collaborative approach. An outline of the objectives of collaboration and a method for establishing it is set out below.

A New Collaborative Approach

The broad principle here is that the greater the number of participants, the greater the synergy opportunities and the greater the chance of levering action within the logistics and network services provider community. By centralizing common activities and ‘leapfrogging’ the current thinking, this will also help to avoid the proliferation of multiple communication and operating standards which add costs. This is envisaged as operating within a free market environment in order to drive synergies and reduce redundancy, therefore leading to lower costs.

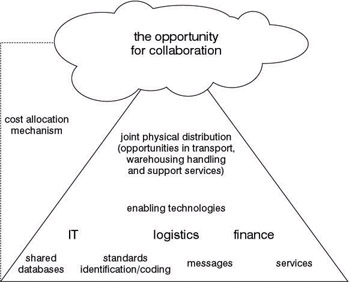

A collaborative approach between manufacturers, their suppliers and customers is envisaged, aimed at optimizing physical flows, executed via a community of service providers, working to common commercial principles. This could feature combined purchasing and operations in physical distribution and sharing of physical logistics resources. This would be supported by a common set of enabling systems and technologies, based upon common standards and a set of common cost measures. This will require an open, competitive market of a large number of service providers (logistics, finance, IT) covering all supply chain functions. (See Figures 8.14 and 8.15.)

Figure 8.14: Opportunity for Collaboration

Figure 8.15: Open Market Solution

The approach to this collaboration is to establish a shared view on how best to achieve the principles above, to promote change to deliver the principles, to support only changes which support the principles and to resist changes which contravene them. The benefits of such collaboration would be that a free market approach fosters choice and competition and the common use of the service providers and common standards reduces redundancy and prevents the proliferation of multiple data formats. In addition, the opportunity for benefit grows with the number of participants and, overall, this is a better way to drive synergies and reduce supply chain costs equitably.

The service provider would manage the pooling of information and provide added value services, such as providing visibility and tracking of transport movements, optimizing transport circuits, managing the disposition of transport assets, consolidation activities, and returnables flows. In addition, central data base applications such as operational analyses and freight bill management could be offered.

Principles for Collaboration

Members of such a working approach will need to obtain agreement on the vision, scope and objectives of collaboration, to develop common principles for commercial dealing and operations, and to build a shared terminology and working standards. They will need to be able to demonstrate consistency and sustainability of performance, transparency of information and mutual trust. Membership should be restricted to parties who have compatible physical characteristics in their supply chains (temperature, product compatibility – non-injurious characteristics such as odour taint). They must be prepared to pool information and be willing to change their current practices. They must be able to exchange data electronically and be prepared to commit both adequate business volumes to the joint enterprise and sufficient human resources to ensure successful participation.

Outline Method for Collaboration

The methodology is based upon a matrix approach. This consists of first identifying focus areas for collaboration and then building a programme based on a number of process steps.

The focus areas are:

- commercial principles;

- network strategy;

- warehouse facilities;

- full vehicle trunking;

- store deliveries;

- IT support.

The process steps are:

- common mind-set;

- communications;

- development;

- planning;

- performance targets;

- performance evaluation;

- process effectiveness;

- continuous development.

Establishing a common mind-set is the process of understanding the mutual objectives of participating businesses. A communication channel and the processes for communication then need to be set up. The development stage is aimed at agreeing the programme of work within which mutual expectations and performance targets will be determined and the resources necessary for implementation and operation agreed. Operating performance needs to be reviewed frequently and appropriate adjustments made. The effectiveness of the process needs to be monitored regularly and a programme for continuous improvement run. The matrix may then be completed and a set of tasks confirmed for each cell (see Figure 8.16).

Figure 8.16: Template for Collaboration

Conclusion

UK replenishment practice is in advance of much of the ECR theory and retailers are in the driving seat. Models of development trends may be built, on to which the position of suppliers and their customers may be mapped. The characteristic features of each stage of each of these evolutionary models determine a number of prerequisite enabling technologies and consequential opportunity technologies. Such an approach can provide valuable insight into possible future retail developments. However, control of the supply chain has long been essential, for short shelf life and private label products. A source of retailers’ competitive advantage is the efficiency of ‘their’ supply chain across the total product range. Logistics efficiency via a single supply chain is therefore their main priority. Consumers judge retailer value (for stock-up shopping) across the total shopping basket but the presence of major brands is also a ‘benchmark of value’. Thus multiple retailers will continue to press for control of the supply chain across their range, including packeted goods, and branded manufacturers must seek a mutually acceptable basis for supply chain development and operations with them in order to remain listed. Managing this together with handling the different supply chains of other trade channels to maximize availability efficiently is the key to growing consumer value.

Common terminology, measures and communication standards are fundamental to industry progress. Manufacturers must therefore focus on and clearly define the processes at the interfaces between their own and retailers’ businesses. They must set up appropriate performance measures and build enabling systems to support the evolution of these interfaces. They must explore ‘opportunity’ technologies and their impacts and prerequisites and creatively re-engineer their use of assets and systems to lever the benefits of these opportunities. EDI should become a strategic thrust of doing business. This will require new EDI message exchanges and standards to be confirmed. Across the chain consolidation opportunities should be explored and wider support sought for such approaches.

There are a number of other implications for manufacturers: they must provide a variety of solutions for different channels and customers. They must have the skill, resources and information available to manage their category in-store, supported by activity-based costing to give internal (and possibly external) transparency to their cost structures. They need to be able to synchronize customer plans with their manufacturing and logistics capability. They must recognize the role of information and information technology in creating this new transparency and in enabling these new methods of working.

There needs to be a new integration of sales and market planning and logistics operations in which visible in-store activity planning can be linked to production scheduling and stock deployment. More responsive physical distribution networks need to be established which can accommodate lead-time compression with the appropriate capacity. Opportunities for resource sharing require the development of the necessary IT capability supported by EDI, traded unit and pallet barcoding and conformity with standard industry data exchange formats. This should be underpinned by cost-related pricing based on activitybased costing. There needs to be clear communication of promotional activity, effective sales forecasting and clear, effective stock management policies supported by flexible manufacturing operations and advanced logistics capability, flexibility and efficiency.

Logistics service providers should be directly involved in the development of these opportunities. This will recognize the prevailing practice of using contract logistics and move the capability of the logistics industry forward by involving third party service companies in ECR initiatives to drive opportunities for synergy and consolidation. This will also increase the accessibility of efficient replenishment opportunities for smaller businesses. It will therefore require the development of standards in terminology, processes and messages between logistics service providers. A huge opportunity awaits the providers of value-added network service vendors in offering the communications infrastructure and management software to facilitate shared-resource operations.

In the United Kingdom the real future for the ‘supply-side’ component of ECR lies in rationalizing and revitalizing the approach to managing transport and consolidation on an industry basis. This will genuinely benefit all parties, including the consumer, but is dependent upon a radical rethink of the way the transport industry currently operates. Is the industry fit for the challenge?

Preface

- Retail Logistics: Changes and Challenges

- Relationships in the Supply Chain

- The Internationalization of the Retail Supply Chain

- Market Orientation and Supply Chain Management in the Fashion Industry

- Fashion Logistics and Quick Response

- Logistics in Tesco: Past, Present and Future

- Temperature-Controlled Supply Chains

- Rethinking Efficient Replenishment in the Grocery Sector

- The Development of E-tail Logistics

- Transforming Technologies: Retail Exchanges and RFID

- Enterprise Resource Planning (ERP) Systems: Issues in Implementation

EAN: 2147483647

Pages: 119