Definitions of Terms

The IASC's Framework describes the basic concepts by which financial statements are prepared. It does so by defining the objective of financial statements; identifying the qualitative characteristics that make information in financial statements useful; and defining the basic elements of financial statements and the concepts for recognizing and measuring them in financial statements.

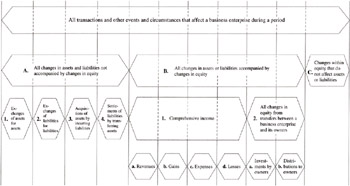

The elements of financial statements are the broad classifications and groupings which convey the substantive financial effects of transactions and events on the reporting entity. To be included in the financial statements, an event or transaction must meet definitional, recognition, and measurement requirements, all of which are set forth in the Framework. Three of the five defined elements (assets, liabilities, and equity) are indicators of the status of an entity at a particular point in time. The others, income and expenses, pertain to the performance of an entity over a period of time.

Elements of balance sheets.

-

Assets—Probable future economic benefits obtained or controlled by a particular entity as a result of past transactions or events.

The following three characteristics must be present for an item to qualify as an asset:

-

The asset must provide probable future economic benefit that enables it to provide future net cash inflows.

-

The entity is able to receive the benefit and restrict other entities' access to that benefit.

-

The event that provides the entity with the right to the benefit has occurred.

Assets remain an economic resource of an enterprise as long as they continue to meet the three requirements identified above. Transactions and operations act to change an entity's assets.

A valuation account is neither an asset nor a liability. Rather, it alters the carrying value of an asset and is not independent of that related asset.

Assets have features that help identify them in that they are exchangeable, legally enforceable, and have future economic benefit (service potential). It is that potential that eventually brings in cash to the entity and that underlies the concept of an asset.

-

Liabilities—Probable future sacrifices of economic benefits arising from present obligations of a particular entity to transfer assets or provide services to other entities in the future as a result of past transactions or events.

The following three characteristics must be present for an item to qualify as a liability:

-

A liability requires that the entity settle a present obligation by the probable future transfer of an asset on demand when a specified event occurs or at a particular date.

-

The obligation cannot be avoided.

-

The event that obligates the entity has occurred.

Liabilities usually result from transactions that enable entities to obtain resources. Other liabilities may arise from nonreciprocal transfers, such as the declaration of dividends to the owners of the entity or the pledge of assets to charitable organizations.

An entity may involuntarily incur a liability. A liability may be imposed on the entity by government or by the court system in the form of taxes, fines, or levies. A liability may arise from price changes or interest rate changes. Liabilities may be legally enforceable or they may be equitable obligations that arise from social, ethical, or moral requirements. Liabilities continue in existence until the entity is no longer responsible for discharging them. A valuation account is not an independent item. It alters the carrying value of a liability and is directly related to that liability.

Most liabilities stem from financial instruments, contracts, and laws, which are legal concepts invented by a sophisticated economy. Enterprises incur liabilities primarily as part of their ongoing economic activities, in exchange for economic resources and services required to operate the business. The end result of a liability is that it takes the use of an asset or the creation of another liability to liquidate it. Liabilities are imposed by agreement, by law, by court, by equitable or constructive obligation, and by business ethics and custom.

The diagram that follows, which is taken from a document that formed part of the conceptual framework project by the US standard-setting body, the Financial Accounting Standards Board, identifies the three classes of events that affect an entity.

-

Equity—The residual interest in the assets that remains after deducting its liabilities. In a business enterprise, the equity is the ownership interest.

Equity arises from the ownership relation and is the basis for distributions of earnings to the owners. Distributions of enterprise assets to owners are voluntary. Equity is increased by owners' investments and comprehensive income and is reduced by distributions to owners. In practice, the distinction between equity and liabilities may be difficult to ascertain. Securities such as convertible debt and certain types of preferred stock may have characteristics of both equity (residual ownership interest) and liabilities (nondiscretionary future sacrifices).

The other elements that change assets, liabilities, and equities are identified and defined in Chapter 3.

EAN: 2147483647

Pages: 147

- ERP System Acquisition: A Process Model and Results From an Austrian Survey

- The Second Wave ERP Market: An Australian Viewpoint

- Enterprise Application Integration: New Solutions for a Solved Problem or a Challenging Research Field?

- Healthcare Information: From Administrative to Practice Databases

- Development of Interactive Web Sites to Enhance Police/Community Relations