Why do 20 percent own 84 percent?

Money is a force, like the wind, the waves, and the weather. Money dislikes being equally distributed. Money clones money.

Why? How can we attract money?

Money obeys the 80/20 principle because of compound interest ” Einstein s most powerful force in the universe.

Start with a small dollop of money, save and invest it, then compound interest will do the rest.

In 1946 Anne Scheiber, who knew little about money, put $5,000 into the stock market. She locked away the share certificates and stopped worrying. By 1995 her modest nest egg had transmogrified into $22,000,000 ” up 440,000 percent! All courtesy of compound interest.

If we never save money, we will always be poor, no matter how much money we earn .

Most people have very little money because they don t save. The typical 50-year-old American has earned a great deal but has savings of just $2,300.

People with the most money have typically saved and invested it for many years . Compound interest multiplies savings in a breathtaking way.

| |

Is it really true, asks Aaron, my personal assistant, that I could become rich?

Yes, I say, if you do one simple thing. Come off it, Richard, that can t be true. Enter Alison, Aaron s younger friend. Alison is a hairdresser with pink, punkish hair. If it was easy, we d all be millionaires. You know as well as me that there are a few people with all this, she waves at the swimming pool, lush gardens, and tennis court , and then there are all the rest of us, struggling with money.

Aaron, Alison, and I are basking in November sunshine, sip- ping ice-cold drinks at my house in Spain. I make the most of my captive audience.

You re right, I tell Alison, most people ” even with big jobs and incomes to match ” don t have much spare cash. I don t say it s easy to accumulate money. I just say it s possible for everyone.

So what s the secret? Aaron is 23, right? Assume he saves $200 a month Pigs will fly, said Alison. Maybe, I say, but imagine he saves and invests $200 a month, and it grows at 10 percent a year for 42 years, until he s65. How much would Aaron have then? $200 a month is $2,400 a year ” times 42 is $100,000 and change. But you have to add the growth on top.

So, I face Aaron, what s your guess? Maybe double that. $200,000? Alison? I m no good at sums, she says, but it couldn t be that much. Maybe $150,000?

The right answer, I reveal, is over $1.4 million. They re stunned.

But that assumes Aaron could save 10 percent ” I don t believe that

Fine, I ll come to that later, I interrupt, but Alison, what about you?

Harrumph, she says. Nobody earns less than me. You know how little hairdressers get? Worst-paid profession. Wouldn t be worth saving.

How old are you? How much do you earn? Eighteen. $16,000 a year. A tenth is $1,600. If I saved that, which I don t think I could, what would my nest egg become?

I produce calculator and paper. The computer is faster, but I want to demonstrate the sums. Aaron fetches more drinks. When he s back, I m ready.

Whaddyathink? If Alison saved $1,600 a year till 65, what would she have?

Aaron grabs the calculator. $1,600 times 47 years equals around $75,000. He multiplies that by five, his estimate for compound interest. $400,000, he guesses.

No way, Alison shrieks. Can t be more than $250,000. Have I got news for you, I tell her. Clich s seem to be expected. The right answer is $1.5 million.

Impossible, she snorts . I earn much less than Aaron, there s not much difference in our age, you say I d get more than him. Calculator must be glitched.

No, I say. It makes sense. The compounding is so powerful, just a few extra years make all the difference. It s more important to start saving early than to earn a lot.

It s all just numbers until you say how we save 10 percent of our pay, said Alison. Don t see how we can, we always spend more than we earn.

I ll come to that later, I said. And I will. But first, should we care about money?

| |

Can money buy happiness?

Yes , if you re poor .

Money is better than poverty, Woody Allen quipped, if only for financial reasons. If we re starving or homeless, money can bring a better life.

But beyond a certain point ” a surprisingly low point ” more money doesn t deliver more happiness.

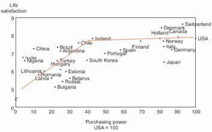

A study of tens of thousands of people in 29 countries compared average life satisfaction in each country with average purchasing power (see Figure 9). [1] It showed that in poor countries, purchasing power and life satisfaction are clearly related . Yet once countries are half as rich as America, there is absolutely no relationship between money and happiness.

Figure 9: Life satisfaction and purchasing power in 29 countries

Looking within individual countries bears this out. Very poor Americans are less happy, but otherwise money does not affect happiness. Being one of the 100 richest Americans adds only a smidgeon to happiness.

Or consider a study of 22 lottery jackpot winners, who showed initial euphoria. It didn t last. Within a year, the winners were no happier than before.

More evidence: real purchasing power in three rich countries doubled between 1950 and 2000, yet happiness levels didn t rise at all. As countries become wealthier, depression soars, with victims also suffering at a much younger age.

The evidence is overwhelming. Being moderately well off means that you are happier than if you were very poor. But once you are well fed, clothed, and housed, getting wealthier probably won t make you happier.

In the nineteenth century, John Stuart Mill gave one excellent reason for this being true ” we don t want to be rich, we just want to be richer than other people . When our living standard improves but everyone else s does too, we don t feel better off. We forget that our cars and houses are better than before, because our friends all drive similar cars and have just as pleasant homes .

Right now, I m living in South Africa. Here, I feel rich. In Europe or America, I don t. My feeling has nothing to do with how well off I am and everything to do with how well off other people are. Living standards are much lower in South Africa, so I feel wealthy.

There s also the pain and hassle of making money. On April 8, 1991, Time magazine s cover story highlighted the price paid for successful careers:

-

61 percent of 500 professionals said that earning a living today requires so much effort that it s difficult to find time to enjoy life.

-

38 percent said that they were cutting back on sleep to earn more money.

-

69 percent said they d like to slow down and live a more relaxed life ; only 19 percent wanted a more exciting, faster paced life.

-

56 percent wanted to find more time for personal interests and hobbies, and 89 percent said it was important to them to spend more time with their families, something that their careers made difficult.

How are we doing now? Have many of us fled the rat race? Nah. We re still chasing more money for more time. The average working American now works 2,000 hours a year. That s two weeks more than in 1980! And the average middle-income couple with children now work 3,918 hours between them ” seven weeks more than just 10 years ago.

More money can be a trap, leading to more spending, more commitments, more worry, more complexity, more time on administering money, more desires, more time at work, less choice about how we spend our time, and degradation of our independence and life energy. Our lifestyle locks us into our workstyle.

How many houses or cars do we need to compensate for heart attacks or depression?

[1] See Martin E P Seligman (2003) Authentic Happiness: Using the New Positive Psychology to Realize Your Potential for Deep Fulfillment, London: Nicholas Brealey.

EAN: 2147483647

Pages: 86