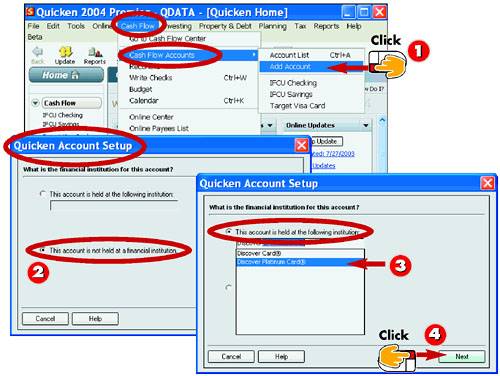

|  Creating a Credit Card Account  -

| Click Cash Flow, Cash Flow Accounts , and then click Add Account . | -

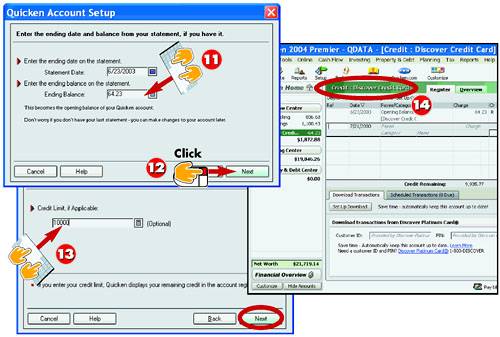

| The Quicken Account Setup dialog box opens. If your card is not associated with a financial institution, choose this option. | -

| If the card is associated with a bank, click this option and type the name of the bank or select it from the pop-up list that appears. | -

| Click the Next button to continue. | INTRODUCTION You can create a special account in Quicken to track your credit cards. Like your account registers for checking and savings, a credit card account enables you to manage how you are using your credit card by recording spending and payments. |

HINT Use the Cash Flow Center You can also start a new account from the Cash Flow Center. Click the Add Account button on the My Data tab to open the Quicken Account Setup dialog box. |

-

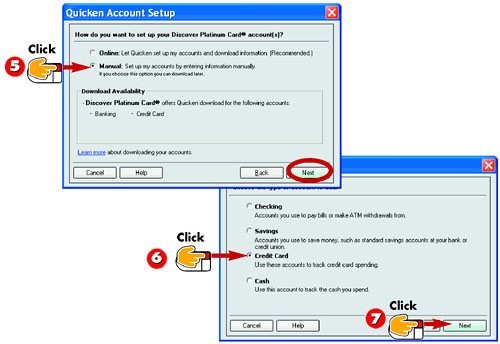

| Quicken may prompt you to sign up for the credit card company's online services. Click Manual for now and activate online features later. Click Next to continue. | -

| Click the Credit Card option to specify the type of account you want to create. | -

| Click Next to continue. | TIP Bank Not Listed? If you enter a bank not listed on Quicken's financial institutions list, another dialog box may appear asking you to match the bank with one on the list. If your bank is listed, select it; if not, click None of These . |

HINT When to Create a Credit Card Account If you carry a balance each month, a credit card account can help you see where you are accumulating debt. |

-

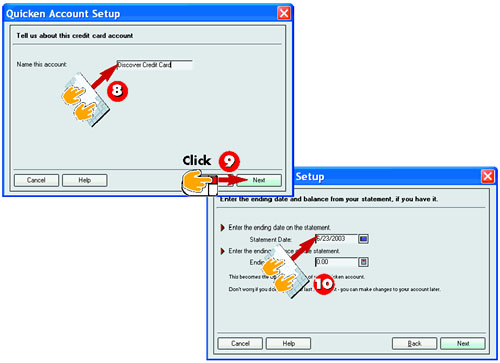

| Type a name for the account or use the default name. | -

| Click Next to continue. | -

| Locate your latest credit card statement and then type a start date for the account. You can use the ending date of your latest statement as the start date. | INTRODUCTION Credit card accounts are designed to track money that you owe. As such, they are organized under Quicken's Cash Flow Center along with your checking and savings accounts. |

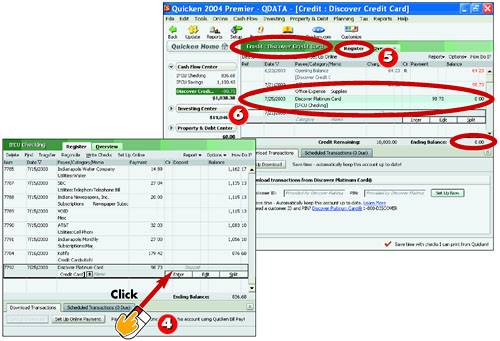

TIP Online Services If your credit card's banking institution offers online services, you can download your online statements. Display the account register for the credit card and then click the Set Up Now button and follow the onscreen prompts. |

-

| Type in the balance owed at the end of the last billing period as the account's opening balance. | -

| Click Next to continue. | -

| Type in the amount of your credit card limit and click Next . | -

| Quicken creates and opens the account register. | TIP Delete It You can easily delete a credit card account you no longer want to track. Open the Account List window, select the account, and click the Delete button. Type Yes into the confirmation box and click OK to permanently remove the account and its transactions. |

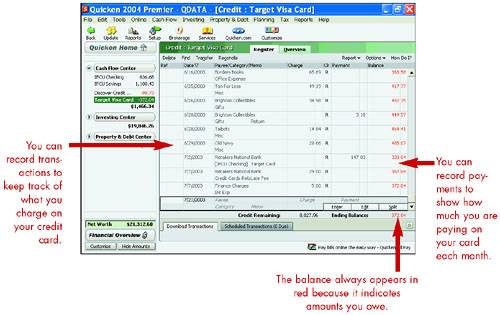

Entering Credit Card Charges  -

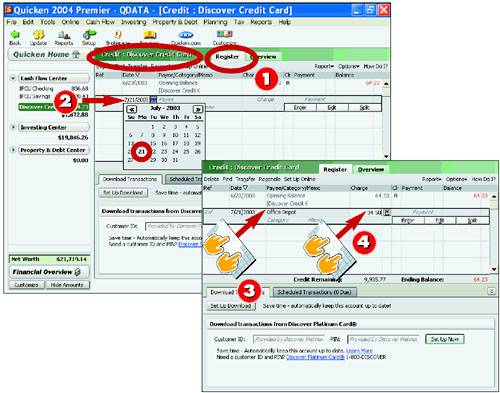

| Click the credit card account in the Account bar to open the credit card register. | -

| Type the charge date for the item you need to record. You can also click the Calendar icon and select a date. | -

| Type in the name of the business or store from which you made the purchase. | -

| Type in the amount of the purchase. | INTRODUCTION You can record two types of transactions in a credit card account: charges and payments. Charges include any purchases you make with the credit card. Charges also include late fees, finance charges, and membership dues. Charges can also be negative, such as for an item you returned; the price is credited back to your account. |

TIP Do I Need a Ref? You can leave the Ref field empty in your credit card register when recording transactions. |

-

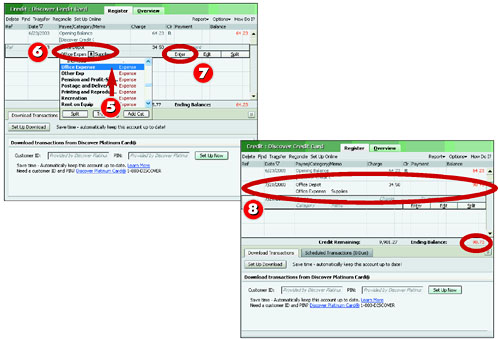

| Assign a category to the transaction. Categories are crucial to track the way in which you use your charge card. | -

| Optionally, you can record details about the purchase in the Memo field. | -

| Click the Enter button. | -

| Quicken records the transaction and displays the new account balance. | TIP My Balance Is Red! Because credit card charges represent money that you owe to the card issuer, the balance Quicken displays is color coded in red. The color red always denotes a negative balance in Quicken. |

HINT Category Help To make the best use of Quicken's tracking features, be sure to assign categories to your credit card transactions. You can then view a report that shows you in what areas you are going into debt. |

Paying Credit Card Bills  -

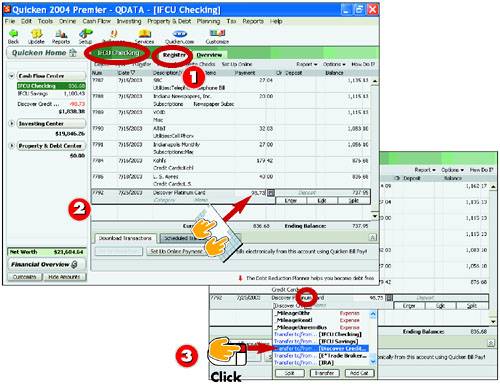

| Open the checking account register. | -

| Enter the transaction showing your payment to the credit card company. | -

| nstead of selecting a category, choose a transfer to the credit card account. You can scroll to the bottom of the category list to find transfer listings. | INTRODUCTION When it comes time to record a payment on your credit card, you can record the payment in your checking account register, but treat the payment as a transfer to the credit card account. Quicken automatically adds the transaction to your credit card account and updates the balance for you. |

-

| Click the Enter button to finish recording the transaction. | -

| Open the credit card account register. | -

| Quicken has recorded the payment and reduced the balance on the card. | TIP Paying Bills Online Click Online, Online Center and choose the financial institution you want to pay. Click Payment Information , then click Make Payment . Confirm the amount you want to pay, click Online Payment, and click OK . Click Update/Send to send the payment instruction. |

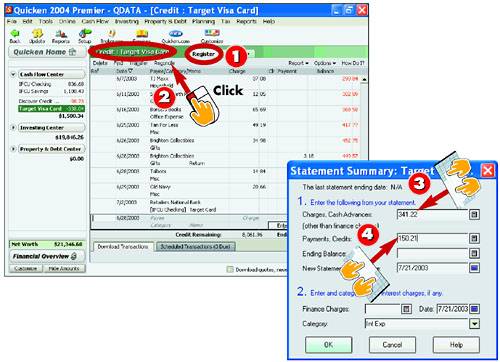

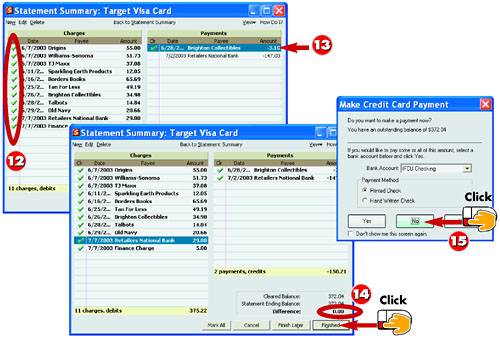

Reconciling a Credit Card Account  -

| With your monthly credit card statement on hand, open the credit card account register. | -

| Click the Reconcile button. | -

| The Statement Summary dialog box opens. Type in the amount of charges as shown on the monthly statement. | -

| Enter the amount of payments and credits as shown on the statement. | INTRODUCTION When you receive your monthly credit card statement, take a moment to reconcile the account. Reconciling a credit card account is similar to reconciling a checking or savings account, with just a few differences. |

TIP Speedy Opening The quickest way to open your credit card account register is to click the account name listed in the Account bar. |

-

| Enter the new balance displayed on the statement. | -

| Click the Calendar icon and select the statement ending date. | -

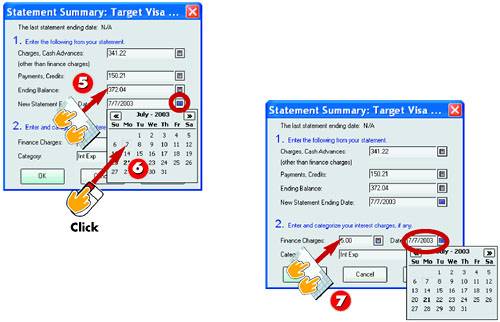

| Enter the finance charges applied during the month and using the Calendar icon, enter the date on which they were applied. | HINT Tab It You can press the Tab key to quickly move from one field in the Statement Summary dialog box to the next. |

-

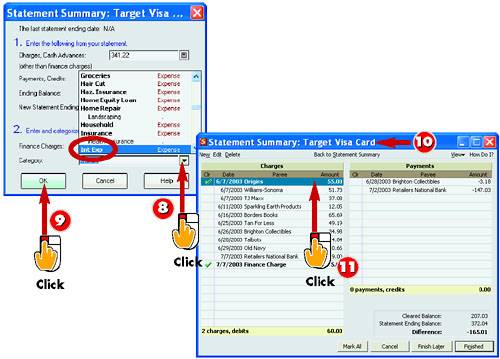

| Use the Category drop-down list to categorize the finance charges as an interest expense by choosing Int Exp from the list. | -

| Click OK . | -

| Quicken opens the Statement Summary window for the account. | -

| Locate the first charge listed on the actual statement and click the charge in the Statement Summary window to mark the charge as cleared. | INTRODUCTION If you are tracking multiple credit cards using Quicken, you'll need to use these same steps to reconcile each account every month. |

TIP Missing Charges If you missed recording any charges, you can do so during reconciliation. Click the Edit button at the top of the Summary window and enter the transaction. Click the Return to Reconcile button to view the Summary window again. |

-

| Repeat step 11 to mark the remaining charges found on the statement. | -

| Next, locate any payments listed on the account statement and click to mark the payments as cleared in the Statement Summary window. | -

| Continue marking off each item on the charge card statement, and then click Finished when the balance is zero. | -

| The Make Credit Card Payment dialog box opens if you still have an outstanding balance on the account. Click No to close the dialog box and make a payment later. | HINT No Payment Required If, after reconciling the account, your balance is zero, a prompt box appears telling you that no payment is required. Click OK . |

TIP Make a Payment To pay on your account from the Make Credit Card Payment dialog box, choose a payment method. If you choose Hand Written Check , Quicken creates a transaction in your account, but it's up to you to write the check. |

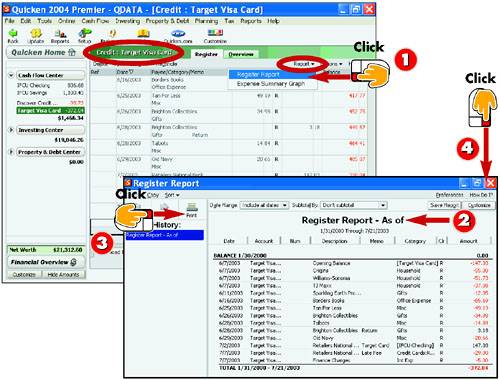

Creating a Register Report  -

| Open the credit card account register, click the Report drop-down arrow and click Register Report . | -

| Quicken opens the Report window and displays a summary of your credit card charges and payments. | -

| Click Print to generate a printout of the report. | -

| Click the Close button to close the Report window. | INTRODUCTION You can view a register report that summarizes your credit card account transactions, showing how much you are spending and how much you are paying on the account. Quicken reports are a great way to view your financial data in detail, and in the case of credit card reports , you can easily keep an eye on what you are charging to your credit card. |

TIP Need a Customized Report? The Report window offers plenty of ways to create a custom report. To learn more about making a customized report, see the task "Creating a Customized Report" in Part 7, "Tracking Your Cash Flow." |

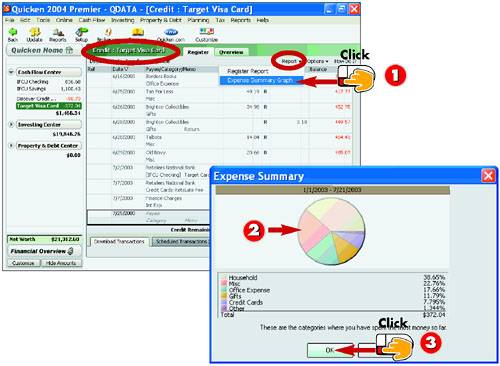

Viewing an Expense Summary Graph  -

| From the credit card account register, click the Report button and click Expense Summary Graph . | -

| Quicken displays the Expense Summary dialog box showing a graph of categorized spending for your credit card. | -

| Click OK to return to the credit card account register. | INTRODUCTION Graphs can speak volumes when it comes to examining where your money goes. The Expense Summary Graph for your credit card account shows you which categories you charge to when you use your charge card. To use this graph, you must faithfully assign categories to the credit card transactions you record. |

TIP Use Those Categories! Categories are an important part of tracking your spending habits. You can learn more about using Quicken categories in Part 2, including how to edit and add new categories. |

|