Stage Theories About the E-Tailing Venture

|

| < Day Day Up > |

|

Before we explain the proposed model in detail, let us review the literature about stage theories in marketing and venture.

Literature on the Stage Theories

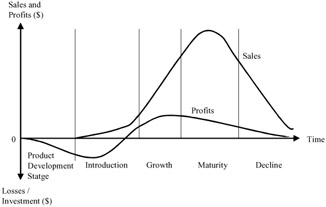

There are many stage theories in the marketing and venture arena. In marketing, the Product Life Cycle Theory (Kotler and Armstrong, 2000; Day, 1981; Ryan and Riggs, 1996; Hedden, 1996) proposed the product life cycle from inception to demise, in terms of sales and profits respectively, identifying five stages: product development, introduction, growth, maturity, and decline (see Figure 1). However, in practice, it is very difficult to forecast the length of each stage and the shape of the product life cycle curve. Since this theory attempts to interpret the stages of product life cycle rather than those of business life cycle, this model is not suitable for explaining the stages of e-tailing business. However, the two factors-sales and profits-are the same as what we adopt.

Figure 1: Sales and Profits Over the Product Life Cycle.

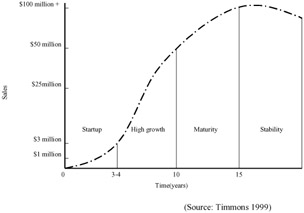

The e-tailing business can be regarded as a venture business (Meeker and Pearson, 1997). So the stage models in venture can be applied to the development of e-tailers' stage model. In the venture's stage model, the stages are categorized into four: startup, high growth, maturity, and stability (see Figure 2). Timmons (1999) studied the time span, sales, and number of employees in each stage. He noted that the shape of the S curve is never smooth, and actually jagged with many ups and downs, and explicit definition about the quantitative measure of each stage is not described in this model.

Figure 2: Stages of Venture Growth.

For the stage model of e-tailing business, we adopt the sales (revenue) and profit (net income) as the determining factors of stages from the product life cycle model. The concept of stages are adopted from the venture model. However, we need to modify the definition of stages to be compatible with the regression model which can identify the stages numerically.

Stages of e-Tailing Business

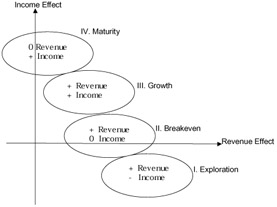

In this study, we regard e-tailing as an innovation and a venture, and we could collect revenue and net income (simply called income) to measure the sales and profit respectively. Based on the levels of revenue and income, we can explain the characteristics of the four stages as follows:

-

Exploration Stage: This stage is a combination of the two stages (startup and high growth) in the venture model. This stage expects an extraordinary high revenue growth, possibly with negative income due to the heavy investment. Stock price may be very high at this stage.

-

Breakeven Stage: After the start-up, failed companies will shakout as the stage progresses. Surviving companies will sustain the high revenue growth but at decelerated rate. Some are profitable and some are not, resulting in the industrial average income near-zero. Let us call this stage the Breakeven Stage.

-

Growth Stage: The surviving companies become more profitable, but the growth rate will decrease. Therefore this stage expects both positive and moderate revenue growth and income.

-

Maturity Stage: The market is saturated at this stage, so there is little chance of high revenue growth. So the business model has no other choice but to pursue high income without significant revenue growth.

This stage theory is easy to comprehend, but it is not easy to distinguish the boundaries between stages. It is not easy to numerically distinguish the definitions of very high, high, and moderate. So we propose the Firm Value Determinant Model to complement such a weakness.

Firm Value Determinants Model

This model observes the determining factors of firm value. The firm value can be measured by the market capitalization, which means the value of total stocks outstanding (Lee et al., 2002). Since we adopted the revenue and net income as the factors, we need to study their impacts on market capitalization. This model can be expressed as the regression model (1).

| (1) |

where

MarCap: Market capitalization;

Revenue: Annual revenue; and

Income: Annual net income.

This model studies the impact on market capitalization instead of the magnitude of revenue and net income per se. In this model, we can estimate the impact of revenue and net income on market capitalization by βR and βI. An advantage of this model is that the stages can be defined based on the sign of βs as follows.

-

Exploration Stage: The high revenue growth implies positive bR, and the negative income implies negative bI.

-

Breakeven Stage: The high revenue growth implies positive bR, and the near-zero income implies insignificant bI. Note that the insignificant bI does not necessarily mean the magnitude of income is near zero.

-

Growth Stage: The positive revenue growth and positive income imply both positive bR and bI.

-

Maturity Stage: The low revenue growth implies insignificant bR, and positive income implies positive bI.

The hypothetical stage theory is graphically depicted in Figure 3.

Figure 3: Stages by the Firm Value Determinant Model.

|

| < Day Day Up > |

|

EAN: 2147483647

Pages: 207