Project Portfolio Management Function Model

|

This function model addresses the responsibility of the PMO to establish and manage processes and activities that give the relevant organization a capability to accomplish project portfolio management. This model illustrates one way in which a PMO can implement the essential steps of project portfolio management. The relative maturity of the PMO will be a factor in the depth and extent to which the prescribed activities are implemented.

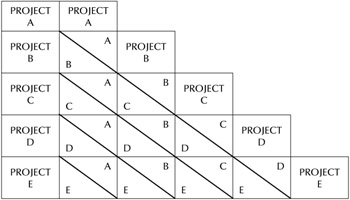

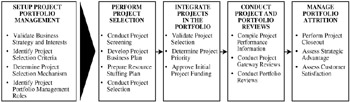

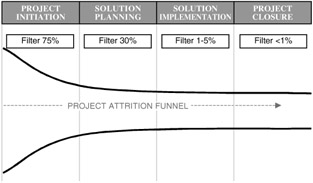

The primary activities of this PMO "project portfolio management" function model are depicted in Figure 17.1. Each activity is described in the following subsections.

Figure 17.1: "Project Portfolio Management" Function Model

Set Up Project Portfolio Management

A foundation for project portfolio management must be established within the relevant organization and its project environment. Several preparation activities are presented to ensure that a solid basis for conducting project portfolio management is established.

Validate Business Strategy and Interests

Executives are responsible for establishing the strategic direction of the organization. The strategy provides the purpose, expectations, goals, and action steps necessary to guide business pursuits. Day-to-day application of the business strategy narrows the range of possible business opportunities to only those distinctly aligned with business objectives. It also ensures that valuable resources are assigned only to those efforts that further the objectives set forth in the strategic business plan.

It is essential that a well-conceived and well-articulated strategic context is available within the PMO in order to align project management activities with top level business direction. In this preparation activity, the PMO examines the existing business strategy documentation and guidance for the relevant organization and collaborates with senior management to verify that it is valid and current. This activity is particularly needed if there has been a long period since the organization's business strategy was last formulated.

If the PMO represents a business unit, e.g., a department or agency, then the parts of the strategic plan that are relevant to the organization should be considered in lieu of the overall organizational business plan. Keep in mind that a "business strategy" exists in some form in any viable organization, although it may be called by different names. Part of this PMO effort may be to discern what business-strategy documents exist, and this effort could include discussions with senior management to identify and locate whatever documentation is available. In any case, the PMO must identify and validate the business objectives of the relevant organization, as they will serve as the basis for establishing the selection criteria used in the project portfolio management process. Table 17.2 presents an abbreviated checklist that can be used to validate business strategy and interests.

|

For established "project portfolio management" functions, this validation activity should be performed on a recurring basis, perhaps annually or biannually, or whenever the strategic business plan or other relevant document is revised or updated. This examination and validation can be done either independently by the PMO or, ideally, in a facilitated review meeting with the executives and senior managers responsible for project portfolio management.

If, by some chance, the PMO discovers that there are no strategic plans, business goals and objectives document, or other business guidance, it will be imperative to facilitate or otherwise arrange a senior management working session to formulate and document the business strategy. This guidance is distinctly needed before project portfolio management can be accomplished.

If projects are already being aligned with strategic business goals and objectives, this provides a distinct advantage and suggests that some form of portfolio management may already be in place. If this is the case, the PMO can concentrate on examining the current process to identify areas of alignment with project management rather than initiating a brand new "project portfolio management" function.

Identify Project Selection Criteria

The process of project selection is that of choosing which project initiatives will be pursued and which will not. The alignment of a project opportunity with the organization's business strategy usually makes it a candidate for selection, but it does not guarantee its selection. Conversely, a project opportunity that is not aligned with the organization's business strategy should never be selected. Project selection criteria should be identified to provide guidance that supports project selection decisions.

The strategic nature of this consideration warrants executives and senior managers be involved in deliberating project selection criteria. To that end, the PMO can facilitate a workshop or similar session to determine what criteria will be used for project selection. Alternatively, the PMO can convene an appropriate senior level panel, executive control board, or even develop and present its own project selection criteria recommendations for review and approval by senior managers.

Projects are initiated in response to a specific business need, condition, or situation that is aligned with the strategic direction of the organization. The PMO can facilitate the examination of four project selection criteria perspectives to help determine the criteria that will ensure project alignment with the business strategy. These are described in the following subsections. The PMO can expand this fundamental list per the nature of business and the needs of the relevant organization.

Business Perspective

The business strategy is supported by particular business objectives that consider sales and revenue objectives, market position, and competitive strategies. Therefore, project selection criteria for this strategy alignment perspective can be developed relative to such factors as:

-

Project costs: Projects are selected based on criteria for achievement of:

-

Project cost reduction initiatives

-

Product/service pricing strategies that cover specific incurred project costs

-

Product/service pricing strategies that attract new, expanded, or specialized business

-

Cost management objectives associated with resource use and optimization

-

-

Product and service quality: Projects are selected based on criteria for achievement of:

-

Product/service-quality measures and objectives

-

Entry of high-quality products/services in the marketplace

-

Delivery of the highest-quality products/services in the industry

-

-

Customer satisfaction: Projects are selected based on criteria for achievement of:

-

Fulfillment of customer needs and requirements

-

Development of customer business relationships

-

Acceptance of customer product and service deliverables

-

Reorders and retention of customers

-

-

Business advantage: Projects are selected based on criteria for achievement of:

-

Increased revenue objectives

-

Enlarged customer base objectives

-

Expanded market share objectives

-

Increased marketplace recognition objectives

-

Global business expansion objectives

-

-

New products/technology: Projects are selected based on criteria for achievement of:

-

New product/service development opportunities and objectives

-

New technology introduction objectives

-

The criteria developed for project selection using business perspective factors will show how well a project fulfills or otherwise supports the organization's business objectives.

Financial Perspective

Each organization and industry has different requirements for the financial returns that are necessary for a project to be considered or approved. These requirements normally are based on the perceived risk and rewards inherent to that industry. Executives must examine the financial parameters of their business and determine what financial factors weigh into the criteria for selecting projects. Project selection criteria for this strategy alignment perspective can be developed relative to such factors as:

-

Investment commitment: Projects are selected based on criteria for achieving the specified limit of the investment amount allowed by type of project. For example, only IT projects under $250,000 will be considered; only construction projects under $1 million will be considered; etc.

-

Investment returns: Projects are selected based on criteria for achieving the specified acceptable range of investment return or objectives for increased investor value. For example, one type of project may require a minimum 12% return, while another high-risk effort can be started only if the return falls into the 15% to 20% range.

-

Investment period: Projects are selected based on criteria for achieving the desired returns within specific acceptable time frames per organizational standards or general industry constraints. For example, a short capital project may be expected to pay back in 3 to 5 years, while a new product launch will be given as long as 5 to 7 years.

-

Investment allocation: Projects are selected based on criteria for achieving the objectives specified by financial funding pools that are established and available for allocation to project work. For example, specified funding pools may be used to allocate investment funds to only a certain classification of projects.

The criteria developed for project selection using financial perspective factors will show that a project has the capability to achieve the specified financial aspects of the business strategy.

Performance Perspective

Projects are selected when general project performance indicators reflect the likelihood of successful outcomes. Executives specify or otherwise influence these criteria against which all projects are evaluated, and they emphasize these criteria at every decision gateway. These criteria inherently expand on the previously discussed business and financial perspectives criteria, and they provide more detail to the project selection effort. Criteria for this strategy alignment perspective can be developed relative to such factors as:

-

Nature of work (competency): Projects are selected based on criteria that confirm the application of existing competencies within the organization to achieve project objectives. Such criteria could specify competency within one or more technical or professional disciplines. It also could specify competency in conducting a particular business process, developing a particular product, or providing a particular service. For example, a checklist could be developed to identify which of the organization's core competencies are being applied to the project under consideration.

-

Extent of work (capability): Projects are selected based on criteria that confirm the organization's capability to fulfill project performance requirements. While an organization has fundamental competency in a technical or professional discipline, it must ascertain its capability (and its limitations) — within the constraints of a particular type of client or industry — to accomplish projects at various and necessarily advanced or higher levels of monetary value, duration, risk, technical or professional discipline diversity, and complexity. For example, an organization may develop criteria that specify selecting a highly complex project of 6-month duration, but not one of 2-year duration.

-

Extent of risk or opportunity: Projects are selected based on the type and amount of technical work performance and business risk the organization is prepared to accept. Therefore, criteria should be created to specify the thresholds of risk that could be encountered as a result of project selection. For example, criteria could be specified for prominent categories of project risk and include the thresholds for project selection.

-

Resource availability: Projects are selected based on the organization's ability to perform the specified work through the assignment of qualified resources. Criteria are formulated to ensure that resource availability — primarily in terms of numbers and necessary skills — is addressed and confirmed prior to project selection.

Nonnumerical Perspective

Projects are selected when business needs warrant them. Executives and senior managers need to identify the criteria that will introduce projects for purposes that are generally outside the first three project selection perspectives. As well, these criteria are often characterized not by using numerical thresholds, but by business decisions. Criteria for this strategy alignment perspective can be developed relative to such factors as:

-

Executive mandate or directive: Projects are selected based on the executive's purview to require them. In such cases, a project is selected and performed because the executive perceives some business value or benefit to be gained by the effort. Often, the executive applies some unspecified "numeric criteria" to such a mandate, and normally such criteria can be found to be an expansion or extension of one or more of the existing criteria in the previous three project selection criteria perspectives. When applied to the project selection process, the executive-mandate criterion simply specifies that when an executive project decision is received, just do it.

-

Operating necessity/infrastructure: Projects are selected to maintain or achieve certain levels of operational efficiency or effectiveness. These types of projects are sometimes selected as part of a larger organizational program or initiative, but often they are selected because of the inherent operational benefits to be received from the proposed project activities, including process development and implementation; infrastructure upgrades; software and computer network system upgrades and implementation; and facility construction, maintenance, and refurbishment. Criteria for this project selection perspective are usually aligned with the need to achieve operating-capability objectives that are specified elsewhere in an organizational initiative or business plan.

-

Competitive necessity: Projects are selected based on the need to maintain business advantage, if not business parity. Project criteria are usually prescribed per specific business, market, or industry indicators. Such criteria include the introduction of new technology, the emergence of new industry or technical-practice standards, and sometimes the need to respond to competitor actions and activities in the marketplace. For example, an organization might select a project when it provides a "facility certification" that its customers require as a basis for ongoing association.

-

Regulatory requirement: Projects are selected based on the need to fulfill external mandates that facilitate business performance or otherwise enable the organization to continue as a viable business entity. Often, government agencies are the source of the regulatory requirements that must be addressed for such purposes as: receiving government-sponsored contracts and business considerations, obtaining business licenses and authorizations, and complying with new or revised laws and regulations. The criteria in this area are simply that of weighing the business impact of nonselection of a fulfillment project versus the benefit of selecting a project for compliance with the imposed mandate.

Determine Project Selection Mechanisms

Once project selection criteria are established, the PMO can construct or use established mechanisms to evaluate the criteria for selecting candidate projects. The mechanisms suggested in this section can be applied to go/no-go decisions at the initial project screening, at project selection, and at each subsequent project decision point.

The six project selection mechanisms presented in the following subsections illustrate a range of project selection mechanisms available to the PMO. The PMO can choose one of these fundamental mechanisms, develop a combined mechanism, develop its own approach, or seek a more comprehensive mechanism from among a variety of advanced tools and techniques available today.

New Project Classification Mechanism

This mechanism is a framework for project selection and evaluation that considers projects in four strategic classifications:

-

Breakthrough: Projects that move the organization to new markets, a new competitive position, or new competencies

-

Evolutionary/extension: Projects that support the internal operational needs of the organization, such as human-resource management systems, financial systems, information management, and decision support

-

Infrastructure: Projects that are an iteration of what the organization is currently doing, capitalizing on a core competency or extending current product lines

-

Customer service and support: Projects that focus on customer expectations, requirements, and improvements to improve competitive advantage

An organization can use these classifications to delineate the nature of work associated with each project and to determine what efforts are being pursued against specific strategic business objectives. Each ongoing and candidate project is listed by its focus and alignment within one of the four classification areas. Then, each project is ranked by importance relative to the achievement of strategic objectives within each of the classifications. This ranking can be supported or adjusted by further examination of subcriteria within each classification (e.g., risk, resource utilization, and investment returns). Table 17.3 illustrates a matrix depicting the new-project classification mechanism. The organization can adapt these classifications to provide better alignment with the strategic nature of its project efforts.

| Breakthrough Projects that move the organization to new markets, new competitive position, or new competencies | Infrastructure Projects that support the internal operational needs of the organization, such as human-resource management systems, financial systems, information management, and decision support | ||||||

| Risk | Resource | Returns | Risk | Resource | Returns | ||

| Project 1 | High | Variable | High | Project 4 | Low | Normal | Variable |

| Project 2 | Project 5 | ||||||

| Project 3 | Project 6 | ||||||

| Evolutionary/Extension Projects that are an iteration of what the organization is currently doing, capitalizing on a core competency or extending current product lines | Customer Service and Support Projects that focus on customer expectations, requirements, and improvements to provide competitive advantage | ||||||

| Risk | Resource | Returns | Risk | Resource | Returns | ||

| Project 7 | Low | Normal | High | Project 10 | Medium-Low | Variable | Medium-High |

| Project 8 | Project 11 | ||||||

| Project 9 | Project 12 | ||||||

Financial Calculations Mechanism

This project selection mechanism is an approach to project selection that considers financial aspects of the project investment and that uses quantifiable metrics and mathematical formulas to distinguish and determine the appropriateness of project selection (and retention). The mechanism simply considers the relevant organization's preferred methods and formulas for cost and financial analysis. Ongoing and candidate projects are scrutinized, and forecasts or results of competing projects are examined. Management can select either a specified number of top project contenders or all projects meeting specified criteria. Table 17.4 presents several representative financial calculations that could be applied to an organization's project selection and retention process.

| Benefit-cost ratio analysis | Financial evaluation that contrasts the benefits to be realized per the varying level of investment cost |

| Economic analysis | Process of establishing project value in relation to other corporate standards, project profitability, benchmarks, financing, interest rates, and acceptance criteria |

| Feasibility study | Method or technique used to examine technical and cost data to determine the economic potential or practicality of the project, such as time-value of money |

| Financing analysis | Techniques and methods related to providing the sources of monies and methods to raise funds for the project |

| Prospectus review | Evaluation of profitability studies and all pertinent technical data in a report presented for acceptance by the sponsor and funding managers of a project |

| Project investment analysis | Evaluation of all the cost elements (capital and operating) of a project as defined by an agreed-upon scope of work that includes costs incurred during the period from the completion of the project to the beginning of normal revenue earnings on operations |

| Inflation/escalation allowance analysis | Evaluation of the factor in cost evaluation that must be predicted to account for price changes with time |

| Cash-flow analysis | Evaluation of monthly in/out and accumulated project cash flow data to measure actual versus budget, allowing for funding at lowest carrying charges and measured spending; includes techniques providing the measure and means to assess total income relative to expended monies (e.g., present value, return on investment, discounted cash flow, internal rate of return, etc.) |

The organization will likely already have robust financial analysis models in place as a fundamental aspect of business management. The PMO should prompt consideration by executives and senior managers to identify financial analysis models that can be applied to project portfolio management, and specifically to project selection and retention.

Balanced-Scorecard Mechanism

This mechanism is a framework for project selection based on the balanced-scorecard evaluation approach developed by Kaplan and Norton. [1] It presents a "whole organization" perspective in four evaluation areas:

-

Financial perspective: Links financial objectives to organizational strategy for improvement of financial performance, and addresses timely and accurate reporting and management of organizational expenses and assets within the project management environment. It includes project management metrics that deal with increasing revenues, lowering costs, improving productivity, upgrading asset utilization, and reducing risk.

-

Business process perspective: Entails specification of internal business processes and activities necessary to support product and service value for customers and shareholders. Measures associated with project management can include such elements as project management and technical performance process time; process quality and process cost; and vendor and supplier selection, performance, and management processes.

-

Customer perspective: Considers the customer and market segments that will deliver the revenue to meet the organization's financial objectives, and specifies the value proposition that will be applied to target customers and segments. Measures associated with project management that help an organization retain and expand its business with targeted customers include such things as product and service quality, timeliness of project deliverables, degree of satisfaction in customer business relationships, and image and reputation in the marketplace and industry.

-

Learning and growth perspective: Provides the infrastructure and capability that enables the other three perspectives to be achieved. This includes a particular focus on capability to implement change for business advantage. For project management, this perspective considers such metrics and measures as tool implementation and utilization, training, quality elements of planning and performance, and application of lessons learned.

This mechanism for project selection focuses on project value relative to these four dimensions of business. Organizational goals are listed for each of the four dimension categories, and measures for attaining the specified goals are added to the matrix. Then, the projects that are under consideration or under way are listed according to the business goals they will achieve. The measures of the projects should match or be related to the measures of the business goals.

Table 17.5 provides an example of the balanced-scorecard matrix used in the project management environment to select or retain projects.

| Financial Perspective | Business Process Perspective | ||||

| Goals | Measures | Projects | Goals | Measures | Projects |

|

|

|

|

|

|

|

| Customer Perspective | Learning and Growth Perspective | ||||

| Goals | Measures | Projects | Goals | Measures | Projects |

|

|

|

|

|

|

|

Rank-Order Matrix Mechanism

This mechanism is a framework for project selection based on a method developed by Buss. [2] It provides a benefit-cost approach that does not rely on quantitative data but, rather, examines and ranks project benefits in four areas that could be interpreted as follows:

-

Financial benefits: Cost versus such metrics as revenue returned and cash flow impacts resulting from the project effort, expense reduction (or increase) resulting from the project management approach, and further business opportunities resulting from project success (or failure)

-

Technical benefits: Cost versus such metrics as opportunity for the introduction of new product(s) and the potential for technical innovation or breakthrough

-

Core competency enhancement: Cost vs. such metrics as demonstration of new or enlarged performance capability and expansion of project manager and project-team member skill and experience

-

Harmony with corporate culture: Cost vs. such metrics as achievement of business objectives that endorse or enhance organizational customs, traditions, and values; fit and impact on the cultural aspects of the organization; and validation of individual affiliation with the organization

Table 17.6 presents a version of the rank-order matrix. While metrics have been suggested for the rank-order matrix, the value of this project selection mechanism is found in the more intuitive nature of evaluating the project cost vs. the discernable benefits to be gained.

| Financial Benefits | Technical Benefits | ||||||

| High benefit | Medium benefit | Low benefit | High benefit | Medium benefit | Low benefit | ||

| High cost | High cost | ||||||

| Medium cost | Medium cost | ||||||

| Low cost | Low cost | ||||||

| Core Competency Enhancement | Harmony with Corporate Culture | ||||||

| High benefit | Medium benefit | Low benefit | High benefit | Medium benefit | Low benefit | ||

| High cost | High cost | ||||||

| Medium cost | Medium cost | ||||||

| Low cost | Low cost | ||||||

Pairwise Comparison Mechanism

Many executives have difficulty making choices when a whole list of options are offered, but they have less difficulty making a selection when pairs of choices are presented. The pairwise comparison method reduces the need to make a choice from a long list of projects. This mechanism facilitates review and prioritization of projects under consideration. Table 17.7 illustrates the grid used for pairwise connection project selection mechanism.

|

|

In a grid pattern, list all the projects on the left side of the page and copy the same list in diagonal boxes to the right. The project at the top left is compared for preference (or another criterion) to the second project named across the right-hand diagonal. If the project on the left is preferable to the project listed in the diagonal, circle the favored one in the "comparison box" between the two projects. Then tally the number of times each project is selected. Rank the projects according to the highest-to-lowest tally numbers resulting from the group effort.

Peer/Oversight Committee Review Mechanism

Whether an individual or group has made project selections, and regardless of the selection method, selected projects should be examined rigorously before they are ultimately entered into the portfolio. A peer/oversight committee review is a means used to challenge each project. The reviewers, comprising either a peer group or a cadre of stakeholders, should convene (a) to confront all assertions and claims of progress, of resources, and of schedules and (b) to address the alignment with strategic objectives. They should look for gaps, overreaching, and unclear detail in each project. Each project sponsor and project manager who has put the project forward should be ready to defend the project. Table 17.8 demonstrates one simple method for approaching and documenting the peer/oversight committee review.

| Project | Sponsor/Project Manager | Argument/Criteria | ||||

|---|---|---|---|---|---|---|

| Project 1 Lab upgrade |

| |||||

| Project 2 New building |

| |||||

| Project 3 Regulatory fix |

| |||||

| Project 4 X-10 system |

| |||||

| Project 5 Method update |

| |||||

| Project 6 Golf tourney |

|

The peer/oversight committee review has two important additional benefits beyond evaluating and clarifying projects. First, each reviewed project is challenged by a fresh perspective and a broad array of expertise; and second, the sponsor, project managers, and reviewer all become more committed to the projects evaluated as a result of delving into the details of each project. Ultimately, key personnel gain knowledge and commitment for all of the projects within the relevant organization.

Identify Project Portfolio Management Roles

Project portfolio management is a business alignment function of the PMO that requires coordination and collaboration across the relevant organization. The activities of project portfolio management will naturally transcend the boundaries of the PMO. However, in the context of its functional responsibility, the PMO must ensure that all participants in project portfolio management know and understand the range of their responsibilities and the extent of their authority to make or implement project portfolio decisions.

Unless specified otherwise, the PMO's primary role is to facilitate the process of project portfolio management. It is possible, and in some organizations likely, that the PMO will take on primary responsibility for conducting project portfolio management activities, sometimes even fulfilling the review and approval role for the organization. Any responsibility in that regard should be identified in the PMO charter.

Beyond the PMO, there are various roles and responsibilities that are needed to support the "project portfolio management" function. A brief description of key portfolio management roles and responsibilities are presented for consideration below. These are practical, generic roles and names that can be adjusted, adapted, or customized for use in an organization pursuing an effective project portfolio management capability.

Executive Review Board

This is the senior management team that serves as the guiding force in developing and implementing an effective portfolio management process. It oversees the portfolio management process and makes go/no-go decisions about the mix, scope, resource allocations, and continuation of projects at specified intervals. This team may include the president/CEO, chief financial officer (budget director), vice presidents, and business unit directors. In some instances in smaller organizations or business units, a single executive may take on this role and associated responsibilities.

The primary responsibilities of the executive review board include:

-

Validate the organization's strategic direction

-

Participate in the development of portfolio management concepts

-

Conduct project screening

-

Review and assess projects at decision points

-

Identify and correct business gaps in projects

-

Balance projects to support the desired mix of business interests

-

Allocate resources (and resolve resource allocation issues)

-

Conduct regular examinations of the organization's competitive position

-

Make decisions on business direction and project funding

Portfolio Management Team

This is the team that serves as the managers of the portfolio management process on an ongoing, operational basis. This team is usually cross functional and provides recommendations to the executive review board for project selection and continuation. This team also compiles project and portfolio information and performs preexecutive reviews as a basis for making portfolio recommendations to the executive review board. The PMO is ideally situated and often assigned to perform in this role or to lead activities for portfolio management team participants.

The primary responsibilities of the portfolio management team include:

-

Conduct project prescreening

-

Ensure completeness of project business plans at selection and decision points

-

Ensure completeness of resource staffing plans at selection and decision points

-

Conduct ongoing examination of projects for compliance with project plans

-

Develop project selection and continuation recommendations at decision points

-

Develop resource utilization and allocation recommendations at decision points

Portfolio Manager

This is a senior manager who serves as the project portfolio administrator within the relevant organization. This is a responsibility that is normally found within the more mature PMO, and therefore is a collateral responsibility of the PMO director. It is a role that represents the essence of the PMO's portfolio management function. This position usually represents the head of the portfolio management team described just above. In smaller organizations, this position alone may perform some or all of the suggested activities of the portfolio management team. Conversely, in larger organizations, some of the portfolio manager's responsibilities may be delegated to the portfolio management team.

The primary responsibilities of the portfolio manager include:

-

Facilitate executive team participation and involvement in establishing portfolio management concepts in the organization

-

Set schedules for project selection meetings and project decision-point reviews

-

Monitor portfolio performance; manage portfolio attrition

-

Manage issues and changes to business plans and resource allocations

-

Facilitate project reporting and communication to the executive review board

-

Link portfolio management information requirements with project management information systems (PMIS) using data included in each project business plan

Project Sponsor

This is the individual who serves as the executive level advocate for the project and represents the interests of the project to the executive team. The sponsor may be an executive team member or a key senior manager who takes responsibility for the project. Typically, there is a project sponsor for every project. This manager could also be a sponsor for multiple projects, possibly a separate subportfolio of projects.

The primary responsibilities of the project sponsor include:

-

Confirm project prescreening results sent to the executive review board

-

Validate initial project business plan and any subsequent changes

-

Validate initial resource staffing plan and any subsequent changes

-

Advocate project selection before the executive team and at decision points

-

Issue the project charter upon project selection and funding approval (or direct the PMO to issue it)

-

Monitor project performance, project risk, and key project objectives, thus ensuring adherence to strategic alignment

-

Serve as the initial point of escalation for resource resolution, negotiating at higher levels for resources that may be needed unexpectedly

Project Manager

This is the individual assigned to lead a specific project with responsibility for that project's outcome. Presumably, there is a project manager for every project in the organization.

The primary responsibilities of the project manager include:

-

Develop the project definition document for integration into the business plan

-

Develop the project business plan with the assistance of the project team and project sponsor

-

Develop the project resource staffing plan with the assistance of the project team and project sponsor

-

Manage project performance on a day-to-day basis, thus ensuring adherence to the project work plan, fidelity to the project business plan, and alignment with strategy

-

Develop and present project performance reports and forecasts of future performance for consideration at decision-point reviews

-

Communicate with all project stakeholders, as necessary

-

Identify and negotiate for timely assignment of resources to conduct the project

-

Continually assess what personnel and financial resources are needed to implement the project plan; make adjustments as necessary

Establish a Supportive Project Environment

The PMO, as the representative of an organization's project management environment, needs to ensure that the project management environment has the capability to support the interests of the PMO's project portfolio management function.

For the most part, portfolio management support needs are established and maintained through the PMO's other functional responsibilities. However, relative to the "project portfolio management" function, the PMO must ensure that such support is fine-tuned to the critical and time-sensitive activities of the relevant organization. In the event that other applicable PMO functions have not been established or matured, the PMO can begin their introduction as elements of the "project portfolio management" function.

The following activities warrant consideration for their benefit in support of an organization's "project portfolio management" function.

-

Methodology deployment: The early project opportunity analysis — including preparation of the project definition and business plan — is normally created consistent with project management methodology guidance. Implementing a project management methodology precludes having a separate process that is used by only a few portfolio management participants.

-

Project reporting: The practices used to collect and report project progress information are important to project selection and for use at project and portfolio reviews. This activity enables preparation of project and portfolio progress reports for distribution to senior management for review.

-

Business policy development: This governance factor is needed to demonstrate executive support and commitment to the portfolio management process. It conveys senior management expectations and may specify responsibilities of the portfolio management participants within the project environment. It can also identify the role of the PMO in project portfolio management.

-

Standards and metrics: This PMO oversight function will contribute to initial development and updates of project selection criteria.

-

Information systems: The established project management information system (PMIS) may require a component to handle project portfolio management data. The interconnection of organizational databases and relevant applications are also considered under this PMO function as a means to support data transfer used in project portfolio management.

The features identified above highlight some of the more prominent activities desired in a supportive project environment. This should not negate consideration of other PMO or organizational functions that warrant early implementation as a means of enhancing portfolio management capability.

Perform Project Selection

The organization's project selection process ensures that all projects are bona fide business efforts and that every project is selected and conducted to implement a business strategy or to support a business objective.

There are four fundamental activities of project selection:

-

Conduct project screening: This activity is conducted to provide an indication of whether or not initial project planning (business plan development) should be pursued.

-

Develop project business plan: This activity is used to identify and examine the project opportunity and customer needs and interests. It collects and compiles the information used in the previous project screening activity, and it includes preparation of the project definition, which specifies the scope and work effort to be undertaken.

-

Develop resource allocation plan: This activity is used to identify resource requirements for the candidate project and to specify the financial and resource allocations that will be needed to fulfill project requirements.

-

Conduct project selection: This activity applies established criteria and prescreening results to the information compiled in the business plan and project resource allocation plan to analyze and examine the candidate project for final selection.

Each of these action steps can be performed as a matter of process contained within the organization's project management methodology, or they can be a separate activity performed only by the portfolio management team.

As well, organizational culture, existing practices and procedures, or applicable policy guidance should be considered and applied to rearrange the order of these action steps, if necessary, to fit the organization. Some organizations may prefer to do more-detailed business planning prior to any context of project screening, and that becomes a "built in" feature of the process. Others may not require as rigorous an effort to initiate a project, but simply a few indicators of business fit. Consider introducing these steps relative to the overall purpose of project selection. Perform all or parts of these action steps in the order and in a way that best fits the relevant organization's needs. A description of each activity is presented in the following subsections.

Conduct Project Screening

The continual application of the same criteria lets managers in the organization know what is important, and ensures that rational decision making is applied when all projects are measured by the same criteria.

Suggested project screening criteria elements include:

-

Customer readiness: Validated need, availability of funding, and effort priority

-

Nature of work: Application of core business competency

-

Return on investment: Project contribution to the overall portfolio

-

Break-even time: Reasonableness of time to payback

-

Competitive position: Project contribution to business pursuits and interests

-

Internal impacts: Project contribution to business lines and organizational interests

-

Market position and market share: Project contribution to market expansion

-

Risk: Benefits to be gained versus potential threats of loss

-

Resource requirements: Application and availability of necessary skills

-

Cost of ownership: Costs of project deliverables

Through activities of the portfolio management team, portfolio manager, or the PMO, the executive participants can review these criteria elements and identify any other specific criteria to be applied to the project screening process.

Screening provides a preliminary examination of the project opportunity and enables the organization to determine whether the opportunity warrants further consideration. The premise that a project must be aligned with business strategy is a focus of project screening. In particular, the criterion established to examine strategic fit is applied here. Opportunities that satisfy the criterion will go forward to further planning and final project selection.

Some organizations may consider this activity to be their project selection step and therefore will conduct project screening as a more rigorous process. This emphasizes the importance of business strategy alignment as the prominent criterion for project selection. As well, it suggests that the organizational project management processes require project selection before any relevant project business plans are prepared. This approach also may warrant a subsequent go/no-go decision to confirm this earlier selection decision.

Develop Project Business Plan

The project business plan identifies and supports the business reasons for conducting the project. In some organizations, this item is known as the "business case." It integrates the project's strategic alignment information, and it introduces the project definition information elements. The project business plan is the governing document in the portfolio management process by which project selection and project continuation decisions can be made.

Business plan development may be a part of a larger process created by the PMO. Once created, project business plan development then can be conducted and managed by the PMO or by a portfolio management team (or portfolio manager).

The project business plan is constructed to contain certain business-relevant project information, which is updated continuously throughout the project management life cycle. Initial and interim reviews of this plan facilitate validation of business purpose (per selection criteria), recurring determination of consistency with the organization's business strategy, and decisions about project continuation.

This activity includes three primary action steps that facilitate the development of the initial project business plan and enable timely updates during the project life cycle.

Identify Project Opportunity

A preliminary examination of the project opportunity must be accomplished in association with business plan development. The following information elements can be considered when identifying the project opportunity:

-

Customer identification

-

Customer point of contact

-

Nature of customer business

-

Type of project

-

Customer's level of interest and pursuit

-

Customer's project funding status

Prepare Project Definition

The project definition provides a complete understanding of the project and serves to guide the project manager and project team in planning and implementation. It also provides the basis of decision making for executives who need to evaluate the potential for project success and completion on time, within budget, and according to performance specifications.

The project definition document can stand alone, but it is presented here as an integral part of the business plan. The project definition contains the information and initial guidance used by the project team when conducting detailed project planning activities. In some organizations, the project definition is completed as an activity contained within the project management methodology process.

The organization should give consideration to the preparation of the following information elements for inclusion in the project definition document. As much detail can accompany each information element as is required by the organization, and more or fewer elements can be included in the project definition.

Key Project Resources. Key project resources include the following:

-

Project manager: The individual responsible for initial and detailed planning and for managing project performance to achieve project objectives.

-

Project sponsor: An individual or group within the organization that provides and manages financial resources, either in cash or in kind, and makes financial decisions to support the project.

-

Project stakeholders: The individuals or groups either actively involved or somewhat associated in the project, and whose interests may be positively or negatively affected as a result of the project outcome. Each individual or group and their interests should be identified.

-

Team resources: An early estimate of resources needed to conduct project work; an element closely coordinated with examining project costs and entails determining what people, equipment, and materials are required by the project.

Project Work Elements. Project work elements include the following:

-

Project objectives: The quantifiable criteria that must be achieved for the project to be considered a success, typically expressed in terms of cost, schedule, and performance measures. Qualitative objectives, such as customer satisfaction, entail high risks and should be restated in a quantifiable manner, if possible.

-

Scope statement: A description of the nature and boundaries of the work to be performed to achieve project objectives.

-

Project justification statement: A statement of the business need or purpose that the project was undertaken to address. Justification points must be carefully considered because they provide a basis for evaluating future project trade-offs or opportunities.

-

Project deliverables: The project outcomes or performance results of the project effort, with consideration of how well each deliverable meets the needs and requirements of the customer and identified business objectives.

-

Preliminary project schedule: An early estimate of the project duration.

-

Preliminary project costs: An early estimate of project costs, usually with emphasis on resource costs.

-

Project milestones: The identifiable points in a project that represent a reporting requirement or completion of a large or important set of activities.

The project definition also may include project manager review comments per an examination of other projects to determine how costing has performed on projects of similar nature and duration.

Project Assumptions and Constraints. Assumptions are factors considered to be true, real, or certain for the purposes of making project decisions. Assumptions involve a degree of risk. Examples of assumptions to be considered include specifications or statements of:

-

Date(s) when a key person is available

-

Budget and resource availability

-

Time requirements

-

Organizational structure and culture

-

Staff availability, training requirements, and experience

-

Number and identity of stakeholders

-

Level of project complexity

-

Size and duration of the project

-

External needs

-

Extent of risks

-

Level of technical capabilities

Constraints are factors that limit the project's options. Specifically, constraints may restrict the planning of project cost, schedule, and resources needed to achieve the project scope; affect when or how an activity can be scheduled; or lead to team pressure to complete the project on time, within budget, and according to specification. Examples of constraints include:

-

Cost

-

Schedule

-

Staffing requirements or availability

-

Funding availability

-

Available technology

-

Contractual factors

-

Government regulations

-

Risk factors

-

Scope expectations and feasibility

-

Market or economic factors

-

Organizational structure

-

Organization's culture

-

Collective bargaining agreements

-

Preferences of the project management team

Preliminary Project Risks. Preliminary project risks include the following:

-

Schedule risks: Risks that can affect the project's completion time, such as the availability of resources and funding, and changing project requirements.

-

Financial risks: Risks that involve cash flow and profitability, including the level of competition, cash flow interruptions, cost overruns, and underestimating the project budget.

-

Technical risks: Risks that relate to the development or operation of the deliverable and involve the level of technological maturity, complexity, and customization needed to develop the deliverable, including problems associated with existing, new, or evolving technology in which the problems or consequences are largely unforeseen.

-

Legal risks: Risks that involve licensing requirements, ambiguous contract language, lawsuits, bankruptcies, and other legal challenges associated with the project.

-

External risks: Risks outside the immediate control or influence of the project manager that may be predictable or unpredictable, including government regulations and mandates, natural hazards, environmental occurrences, changes in public interest, market changes, currency changes, inflation, and taxation.

Integrate and Expand Business Basis Information

The integration of relevant business information is the final step in preparing the project business plan. If prescreening was completed prior to this step, then initial strategy alignment data should be available for incorporation. Otherwise, this information will need to be compiled and included as part of the important business basis information.

The specific content and format of the project business plan is a matter of the organization's established documentation practices or preferences. The practical consideration of this component is to provide all necessary information to enable a detailed opportunity evaluation for project selection. This includes consideration for incorporating the following information elements:

-

Strategy alignment/business objectives

-

Business interest

-

Financial analyses

-

Customer analyses

In addition to considering these information elements, any other information needed to make a decision regarding opportunity examination and project selection should be incorporated into the project business plan.

Develop Project Resource Staffing Plan

Projects can go forward only with adequate resources to support them. Ordinarily, an organization has limits on resources and must make choices about which projects to support. Project selection, nonselection, termination, or adjustment is dependent, ultimately, on the availability of resources to support projects. Consequently, considerations for allocation of the organization's resources are an integral part of project selection.

This plan can be developed separately or incorporated as part of the project business plan. It also should be noted that this activity step might be performed as a part of project initiation activities conducted by the project manager as guided by the project management methodology process. Three primary activity steps can be applied to create a resource allocation plan, and these are described in the following subsections.

Identify Financial Impacts of Staffing Requirements

Each project opportunity must be reviewed for anticipated financial impacts of staffing requirements. This review can include the examination of the following elements:

-

Resource requirements: The project business plan may provide a preliminary determination of resource requirements. Review that preliminary information and formulate additional information to ensure that both financial and personnel issues have been considered. Note that the development of project resource requirements can be done in conjunction with and using the tools of an established project methodology process step. Relevant considerations regarding resource requirements include:

-

What resources are currently required? What is projected for the future?

-

What personnel can be assigned to this project? What is the cumulative impact of all personnel requirements?

-

Is resource availability within our current capability? Are external resources needed? Are financing and partnering capabilities available?

-

Are resources available to achieve the current project scope? Are scope adjustments needed to better utilize resources?

-

How will project schedules impact workload? Are adjustments needed?

-

Are personnel overutilized or underutilized? Are certain resource skill types overburdened? Do current personnel need additional training to meet anticipated project requirements?

-

-

Project cost and schedule impacts: Costs for specific skills, unique specialties, or turnovers during the project — all of which raise the costs of projects over time — should be evaluated. Information to be examined includes:

-

Are all necessary skills available within the company, or is external resource acquisition necessary?

-

Are the skills necessary to complete the project part of the core competency, or is this a new business area?

-

What is the time dimension for the project under evaluation and for all projects using the same resources? Will the deadline or the cumulative impact of all affected projects require funding of outside assistance?

-

-

Quality management: Both anticipated and unexpected changes in the quality factors of the project and in the people required to ensure quality may incur cost adjustments as the project goes forward. This warrants examination of:

-

What quality specifications in the project might generate personnel costs?

-

Will a different level of product or service quality expectation require a new level of effort that will affect resource allocations and costs?

-

Does the required resource level for quality expectations exist within the organization?

-

-

Supplier, contractor, or subcontractor agreements: External agreements and arrangements may affect pricing, over time. Identifying and accessing external resources can save costs:

-

What agreements have been made with external organizations?

-

Are firm commitments needed early in this project?

-

What external supplier, contractor, or subcontractor costs for products and services stay the same or increase over the life of the project?

-

-

Costing methods: The use of different costing methods can produce different results, and these must be normalized. Alternatively, the organization can use standard methods across all projects. Note that the financial and personnel resource requirements developed in this step will be included in the resource allocation plan. A review of methods helps to ensure costing method accuracy:

-

What cost methods have been used? Hours versus dollars? Are the methods consistent across the period of project work?

-

Will the skill mix required on the project change over time? Will that change affect costs and internal or external personnel utilization?

-

Have all costs been accounted for in each project? (For example, have administrative and support costs been included in all projects?)

-

Have previous projects' cost data been used to estimate costs here?

-

What technology enhancements might be utilized to reduce personnel costs across all projects?

-

Review Organizational Resource Utilization Impacts

Resource requirements for the current project opportunity should be evaluated against the total portfolio of projects. This examination can be presented using a spreadsheet or other analytical tool. It includes examination of other projects' resource allocation plans (or extracted summaries), and it provides for a review of the total financial commitments and staffing requirements tallied across all projects. The following considerations can be deliberated:

-

Are the resource projections within the limits of the organization if this project is added to the portfolio?

-

Are changes to project scope or outside financing needed to do this project?

-

Is the pending resource utilization commitment financially sound? Is there flexibility to handle unanticipated changes?

-

What is the total impact on resource availability relative to the number and types of particular skills available?

-

Do interests in applying resources to this project make any other projects stand out to be adjusted or eliminated?

-

Relative to resource skill and availability, is this project too big? Too risky? Too unknown? Of marginal benefit?

-

Can project schedules be adjusted or scope scaled differently to have a different impact on financial resources or on resource utilization?

-

Can personnel be grouped or clustered so that several projects can be supported simultaneously?

Key points of this examination of the impact on organizational resources should be included in the resource allocation plan.

Develop Resource Staffing Plan

Once the financial and resource impacts are specified, resource allocations can be developed and finalized. In general, the following should be specified in a resource allocation plan for each project:

-

Project resource requirements by skill and experience levels required (including financial commitments)

-

Internal resource allocations by major time increments (e.g., quarterly), including the planned approach to identifying and acquiring individuals, by name, and the schedule for internal resource acquisition activities

-

External resource allocations by major time increments (e.g., quarterly), including the planned approach to identifying and establishing contracts for external participants and the schedule of external resource acquisition activities

-

Identifiable resource allocation conflicts (within the portfolio)

-

General and specific resource training required to increase individual skill and competency, and to address the use of any new technology or processes

-

Oversight required for resource allocation management for this project, i.e., issues to monitor, recommended frequency of resource allocation review, etc.

The resource staffing plan becomes the ongoing portfolio level budgeting document for this project in the project portfolio management process. The resource allocation plan is reviewed (a) when this and other projects move into new phases or undergo plan revision and (b) as projects are added to or terminated from the portfolio.

Conduct Project Selection

The PMO should ensure that a viable project selection process is developed and implemented. This begins with consideration of several principles that can be applied to the decision-making process to support better project choices:

-

Principle 1: Be explicit about the selection criteria and ensure that all projects are held to the same standard no matter how many interesting options may be available.

-

Principle 2: Be clear about the procedure for choosing projects and ensure that all projects are selected by the same method.

-

Principle 3: Be prepared to challenge (and defend) all assertions in a project business plan, since overly rosy or incomplete predictions do not promote success.

-

Principle 4: Convene a review group of diverse stakeholders to review project selections, since the impact of all projects will cross the organization and have impacts outside it.

-

Principle 5: Include the project management staff, as is consistent with organizational practices, in the project selection process.

In the past, organizations have typically emphasized financial goals as indicators of performance, almost to the exclusion of other values in the organization. Benefit-cost ratios, return-on-investment, and stockholder value have been typical quantitative measures employed. Increasingly, organizations are realizing that they need a broader decision framework than just financial performance for the organization to continue to survive and thrive in a more holistic but fast-paced business environment.

In general, project selection methods range from simple paper and pencil calculations to highly analytical and mathematical models, to value-driven and performance-based methods, to decision software packages. A thorough review of selection framework models should be conducted before a single framework is adopted to ensure that a method is chosen that matches the strategic intention and business operations of the organization.

The executive review board should conduct project screening, with the portfolio management team (ideally with PMO leadership) as the next-best group for this task. Participants begin with an individual and independent review of the selection materials created to date. The team then convenes to deliberate and discuss the merits of the business and resource allocation plans, making any adjustments deemed appropriate through consensus, and then examining the project opportunity. Areas of team review should focus on:

-

Consistency with strategic objectives (with project screening)

-

Project opportunity business evaluation (using the established screening method)

-

Business and project risk indicators

-

Point(s) of executive participation in business plan review

-

Subsequent decision points for further project examination

-

Recommended project position within the portfolio

-

Decision appeal options (for project sponsor or project manager)

This activity is best achieved through an expert-led facilitation that the PMO can provide. This activity should lead to a decision toward one of the following actions:

-

Select project and proceed with detailed project planning

-

Select project and hold, pending a project start date to be determined

-

Withhold selection, pending a request for more information and further review

-

Nonselect project and discontinue opportunity evaluation

This activity determines whether or not a project is selected for inclusion in the relevant organization's project portfolio. The results of this deliberation can be either a mandate to proceed or a recommendation of project selection to the relevant executive authority. A project that is not selected is normally not reported to the executive authority.

Integrate Projects in the Portfolio

The practice of effective project portfolio management inherently requires the participation of the executive portfolio owner. If that individual executive review team (portfolio owner) has not yet been involved in the initial selection activities, it is essential that executive participation begin at this juncture in the project portfolio management process.

There are three activities performed to achieve project integration:

-

Validate project selection: A final executive level reviewer signs off on the business plan as the approved approach for conducting the project. The executive reviewer also signs off on the resource allocation plan, if presented as a separate document, as the approved approach for staffing the project.

-

Determine project priority: The executive portfolio owner assigns a project ranking within the portfolio of projects.

-

Approve initial project funding: The executive portfolio owner signs off on project funding to enable the project to be "booked" and to authorize the expenditure of money for the specified initial project planning effort.

It should be noted that this activity can be performed as a part of the project selection effort conducted by members of the executive review board, or it can be conducted as a separate activity performed by the portfolio management team (or portfolio manager), with participation and sign-off by the relevant executive owner. A discussion of the concepts for accomplishing these action steps is presented in the following subsections.

Validate Project Selection

The project business plan and project resource allocation plan are subjected to a final review by either individual executives or in conjunction with a meeting of an executive review board. If project selection actions precede executive review, the relevant executive may opt to examine an abbreviated project selection document or selection recommendation document, with access to the actual project business plan and resource allocation plan, as needed.

The designated executive reviewer signs the business plan (and resource allocation plan) to assert the following:

-

Project consistency with the organization's business objectives and interests

-

An awareness of business issues and risks associated with the project

-

Approval of the high level approach to conducting the project

-

Approval of the specified resource allocations

-

Frequency of review and the next scheduled project review date

-

Approval to proceed with the project

These validated elements serve as the basis for developing the project charter, which is normally prepared by the project sponsor or project manager under guidance contained in the organization's project management methodology.

Determine Project Priority

When project opportunities are being considered for selection, a resource calculation is made, and each project is prioritized or adjusted based on its fit in the portfolio. As projects are introduced into the portfolio, each project should be ranked in order of priority. This allows senior management to maximize support to critically important projects and to perform ongoing evaluation of other projects, sometimes terminating projects of lesser importance or value to allow higher priority projects to enter the portfolio and be sustained.

If the relevant organization has discrete business units, this prioritization and ranking is particularly important, because projects initiated within a business unit may require adjustments relative to other projects in other business units across the whole organization. The position of all projects within the portfolio should be reevaluated at portfolio reviews and with every new project addition or project termination. The position within the portfolio provides a guide to the relevant organization about intent and means to achieve strategic goals.

In this activity step, the executive examines the fit of each newly selected project and assigns it a priority within the portfolio. This assignment will likely affect the position of all other projects already in the portfolio; therefore, part of this effort includes realignment of project priorities across the entire portfolio. The PMO can assist in this effort when there are established formulas for project prioritization.

Approve Initial Project Funding

This action step authorizes funds for conducting at least initial project planning, if not for conducting the entire project. Essentially, the relevant executive signs the authorization to release funds and start the project. The nature and duration of the project may warrant initial full funding. Otherwise, funding approval can be incremental, and additional fund authorizations can be accomplished at project and portfolio review points.

Funding approval can be part of the sign-off of the project's business and resource staffing plans, or it can be conducted as a separate act. There may be a preference to have a separate funding approval document that can be prepared and distributed to other departments in the organization that require notification of funding approval but that do not have a need for copies of the project's business and resource allocation plans.

Like the project business and resource staffing plans, funding authorization is passed for inclusion in the project charter.

Conduct Project and Portfolio Reviews

The essence of project portfolio management is reflected in the ongoing participation of executives and senior managers in reviewing individual projects and the overall portfolio on a recurring basis. These reviews are key to keeping projects and related activities on course toward the achievement of strategic business objectives. Review activities must demonstrate sufficient rigor to enable serious business decisions to be made. In particular, project level reviews must present adequate examination to make decisions about project continuation or project termination. Portfolio level reviews must provide the necessary information to judge business results for the collection of projects in the portfolio.

There are three primary activities to accomplish in conducting project and portfolio reviews:

-

Compile project performance information: A process linked to the project collaboration and project status reporting capabilities is implemented to ensure that appropriate information is collected and compiled for use in project and portfolio reviews.

-

Conduct project gateway reviews: The practice of when and how to evaluate active projects is established.

-

Conduct portfolio reviews: The practice of when and how to examine the total collection of projects in the relevant organization's portfolio is established.

A suggested approach for accomplishing each of these action steps is provided in the following subsections.

Compile Project Performance Information

The PMO is the communication link between senior management and the project environment. The PMO specifically facilitates organizing reports to management, although this responsibility could be delegated to a portfolio manager or portfolio management team. Nevertheless, it is likely that the PMO will play a role in establishing the project reporting capability within the relevant organization. Therefore, it must coordinate and perhaps facilitate report content development with the executive review board or other designated portfolio management authority.

A progress or status report developed for use in project and portfolio management reviews must be generated at the project level, by the project manager, on a recurring basis. This very well may be the single monthly report that is produced under guidance contained in the project management methodology. This is recommended as a matter of maximizing the efficiency of reporting project progress. This report already provides the essential project information needed to ascertain the state of project performance, and it normally includes the following or similar data elements:

-

Indication of project status (e.g., green, on track; yellow, issues; red, troubled)

-

Significant accomplishments

-

Open action items

-

Milestone/deliverables status

-

Cost, schedule, and resource utilization status

-

Key project issues

-

Scope-change status

The PMO should work with key stakeholders to specify and format the desired content. The frequency and timing of such project level reports to management should be established to accommodate portfolio management review activities. If required, supplementary reports can be established to satisfy "off-cycle" project reporting needs, but such reports should be an exception rather than standard practice for the sake of efficiency.

The process of compiling project information for portfolio level reviews may warrant an additional reporting step. That step is the intermediate examination of compiled project data by the PMO, portfolio manager, or portfolio management team. This examination will be performed by middle to senior managers with a focus on interpreting project status report information, including calculating additional financial indicators used by executives, verifying project alignment with strategy (as specified in the project business plan), and checking resource utilization against resource allocations. This "special" report can be designed for use in either project reviews or portfolio reviews, or both.

Conduct Project Gateway Reviews

Ongoing executive reviews and decisions ensure that each project within the portfolio continues to contribute to the overall strategic business interests of the organization. A standard decision-making process should be adopted, and project gateway decision points should be implemented to occur at project life cycle phase-transition junctures or at other points deemed appropriate by the executive review team.

The standardization of portfolio decisions ensures that all projects are examined from a common frame of reference and that the entire portfolio can be viewed from that frame of reference. The specification of decision points ensures that each project is revalidated regularly throughout its life cycle and that all key stakeholders know when those reevaluation decisions are scheduled and made.

The project gateway review process comprises the following five activities:

-

Validate business plan

-

Assess project performance

-

Evaluate resource allocation

-

Confirm position within the portfolio project

-

Make continuation decision

These activities are performed by the executive review team or other designated portfolio management authority to ensure that an effective project review is accomplished. These five activities are described in the following subsections.

Validate the Business Plan

The business plan review has a focus on different elements as it progresses through the portfolio management process. These different elements support the different decision requirements of a particular project management phase. In general, after initial selection, the validation of the business plan is accomplished according to a review of elements associated with the project phase decision points encountered:

-

Solution planning phase: The business plan review has a focus on any changes to scope, cost, risk, and other initial selection criteria.

-